9 min read

Winning in the Boardroom of CFI Clients

Winning in the Boardroom of CFI Clients

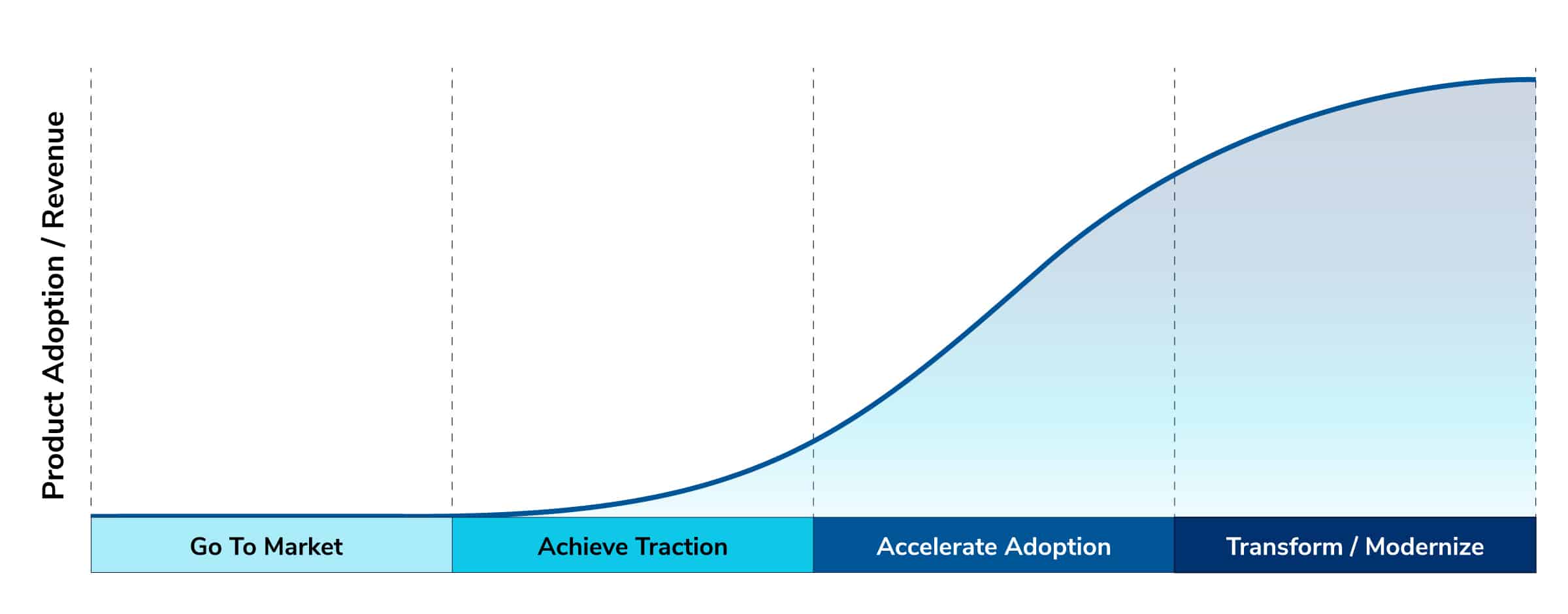

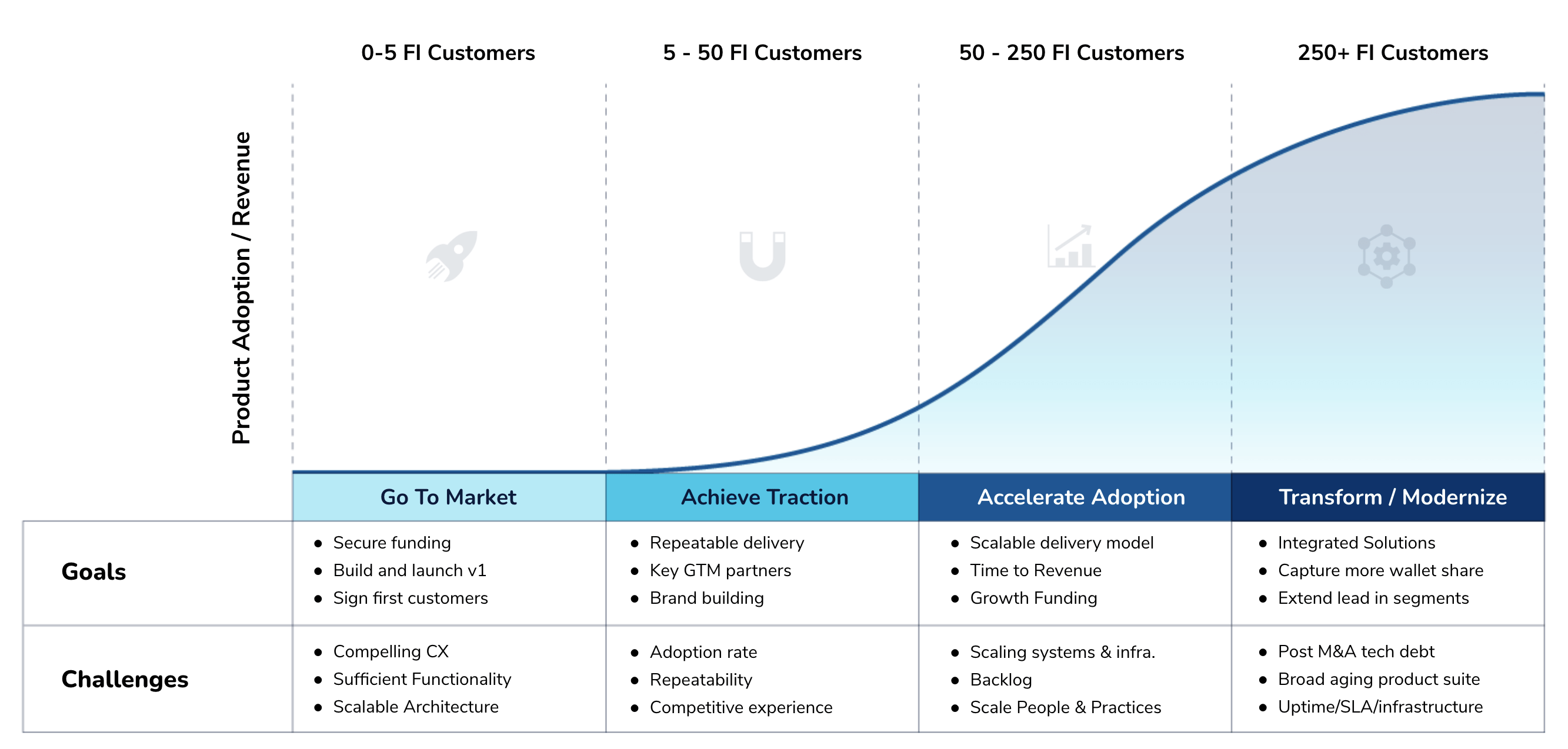

Understanding the 4 stages of the software adoption lifecycle and each of their challenges in creating a great cx

As with all products, there is an adoption lifecycle for fintech software products. Heads of Product as well as technical and business leaders at fintech software companies understand that creating and delivering a holistic digital customer experience is a critical source of competitive differentiation, helping to close more deals, increase adoption and customer success, and drive customer growth and retention. For a fintech, this includes not just their customers, but their customers’ customers as well. That’s a lot of customer success to be responsible for — and a lot of potential for growth, when done correctly.

How CX May Be Holding Fintechs Back

Digital CX expertise is becoming a key competitive differentiator. But significant challenges are just as prevalent as the recognized market need for great CX. Here’s how your CX could be holding you back from growth at the various stages of the fintech software product adoption lifecycle.

Go To Market Challenges

Whether an established company with a new product on offer or a start-up still seeking to hone in on product-market fit, fintechs at this stage have a compelling, pre-revenue product and the focus is set on making those sales. But significant challenges to growth are just as prevalent as the recognized market need for great CX.

At this stage a fintech may be just barely in the market, with little to no adoption of an immature product and plenty of speed bumps along the way. Whether startup or established, the sales environment amongst fintech software providers is highly competitive — making the need for more advanced digital CX even more salient.

Early stage fintechs are aware that digital CX personalization is becoming a key competitive differentiator — but a lack of third party analysis and validation of best practices often cause them blindspots. If it weren’t for those blindspots, those speed bumps would be much less bumpy, and adoption rates could rise.

When we work with fintechs struggling to increase sales, we recommend they take a look at the internal biases and competing interests at play within the company. It happens all the time — we get too close to our own projects to see the full picture. At this stage, fintechs may benefit greatly from bringing in an impartial outside perspective with deep expertise in CX — which may also help align the team’s vision like never before.

Learn more about improving the CX for fintechs in the Go To Market stage >

Achieve Traction Challenges

Fintechs at this stage are still fairly new to the market, and while they’ve made some sales, they aren’t flowing predictably yet. Here, companies are still working out product-market fit, and while they could be great, they haven’t nailed just what it is they want to be the greatest at yet. While highly aware of the need for great digital CX, the truth is, often they are still working out some basic capabilities at this stage.

Capabilities challenges may include a lack of integrations with other fintech products and legacy systems via ecosystem partnerships, or core integrations. The product may also be limited in terms of customization and configurability — and the CX personalization bar is constantly being raised. Many fintechs at this stage still don’t truly, deeply understand the process by which their customer acquires value from their product.

Often internal digital CX expertise is limited, or they may lack the time and resources to fully assess where they stand in the market. While they’ve often done well enough filling in the gaps up until this point, their focus shifts to improving conversion, acquisition, and retention numbers with a more focused approach.

At this stage, fintechs most benefit from obtaining an objective perspective on how their product compares to others on the market. This perspective should utilize a clear methodology, and the assessment should include actionable insights on why customers choose to buy one fintech product over the other.

Learn more about improving the CX for fintechs in the Achieve Traction stage >

Accelerate Adoption Challenges

At this stage a fintech has found product-market fit and is seeing consistency in sales. The product is gold — but only as long as they stay ahead of the constant race to beat their competitors and retain market share. Products at this stage have limitations — but fintechs simply can’t bring in all the talent they need fast enough, or deliver fast enough, to capture all the opportunities available.

Here, more than ever, the challenge lies in being the one who raises the CX bar of excellence for the rest of the pack. To be the competitor, fintechs must move quickly — but not so quickly that they risk design debt. It’s crucial for fintechs at this stage to give their internal designers more capacity to think deeply about creating a more holistic digital customer experience rather than remaining solely focused on design QA and compliance. This thoughtful approach is what’s needed to raise the bar.

However, it also risks missing revenue targets, producing high labor costs, and without objectivity, a lack of competitive differentiation. Not to mention, the product still has to perform. It’s important for fintechs to remember, they don’t have to go it alone — at this stage, they can benefit greatly from increasing their team’s capacity by bringing on outside expertise in fintech CX — saving valuable time and skipping the endless domain knowledge walkthroughs. By choosing a trustworthy partner, they’ll be prepared to scale without taking on design debt.

Learn more about improving the CX for fintechs at the Accelerate Adoption stage >

Transform / Modernize Challenges

At this stage, a fintech is considered an established company with a solid product-market fit. They are beating out the competition — but this comes at the detriment of the very product that put them here in the first place. Here, they are intimately familiar with the challenges of technical and design debt, having implemented patches and quick fixes as needed to get the product and acquisitions to market. It happens.

In many cases these fintech products are considered a legacy product (in the technology world anyway) — and when that’s the case, the digital CX leaves something to be desired. Like the previous stages, the team is often very aware of the drive towards personalization and customization, but is stuck in terms of how they can reconfigure the product to fit.

The challenge also lies in the complexity of relationships — all those integrations with other fintech products and legacy systems via M&A, ecosystem partnerships, or core integrations — and in finding reliable, skilled implementation partners. In short? Fintechs at this stage need to be able to make a transformative CX upgrade and increase their design capacity to get competitive features to market quickly. That’s a tall order. But here’s why it’s essential — decay.

Much like other life cycles, the software adoption lifecycle has its own seasons of decay. For older fintechs, this includes a declining trend in sales and customer retention, outdated applications, as well as ever-mounting technical and design debt. Fintechs who are in this critical stage know the time to invest in rapid transformation is at hand — or death is inevitable.

At this stage, fintechs may even need to reimagine their entire product experience to be more consistent with current standards and regulations. Accessibility may be an issue. Full mobile support may need to be prioritized. Poorly performing systems that lack speed, availability, stability and scalability dramatically impact conversion rates, drop rates, support load, and customer satisfaction. On top of which, all the challenges the previous three stages have faced may come down to bear upon the decaying fintech at once.

Band aid solutions will simply no longer suffice. These issues put the product’s future at risk and require a transformation. To do so, fintechs at this stage often need an external perspective to help direct alignment amongst the team around how to get unstuck. This will enable them to either take control of your legacy product before it starts declining — or to reimagine the entire experience and modernize the product.

Learn more about improving the CX for fintechs at the Transform/Modernize stage >

A Holistic Approach to Digital Customer Experience Challenges — No Matter The Stage

Rather than tackling any singular CX challenge head on, innovative fintech leaders are looking at CX in a far more holistic way by addressing:

- The core product CX

- Customizations that support CX personalization and FI brand support

- Understanding and addressing how both FIs and consumers use and engage with the product

- CX as a function of system performance, stability and scalability across the entire ecosystem

- Alignment between internal business and technical stakeholders

- How to identify and track key metrics for CX success

With many competing internal voices — who are often far too close to the problem to see it clearly– engaging with an impartial, outside perspective can add valuable outside insight that is clear and three-dimensional. This insight should include actionable input from customers to ensure that the team’s view is clear, holistic, and positions the company for a transformation that is aligned with the changing needs of the market.

Praxent is an expert in software design and development with deep fintech domain knowledge. If you’re at the crossroads of transformation, we can help with a high-level assessment of your CX and prioritized recommendations to transform your product’s CX.

Leave a Reply