8 min read

How New Fintechs Overcome CX Challenges and Increase FI Sales

How New Fintechs Overcome CX Challenges and Increase FI Sales

Understanding how the unique CX challenges for fintechs in the ‘Go To Market’ stage of the product lifecycle impact FI sales

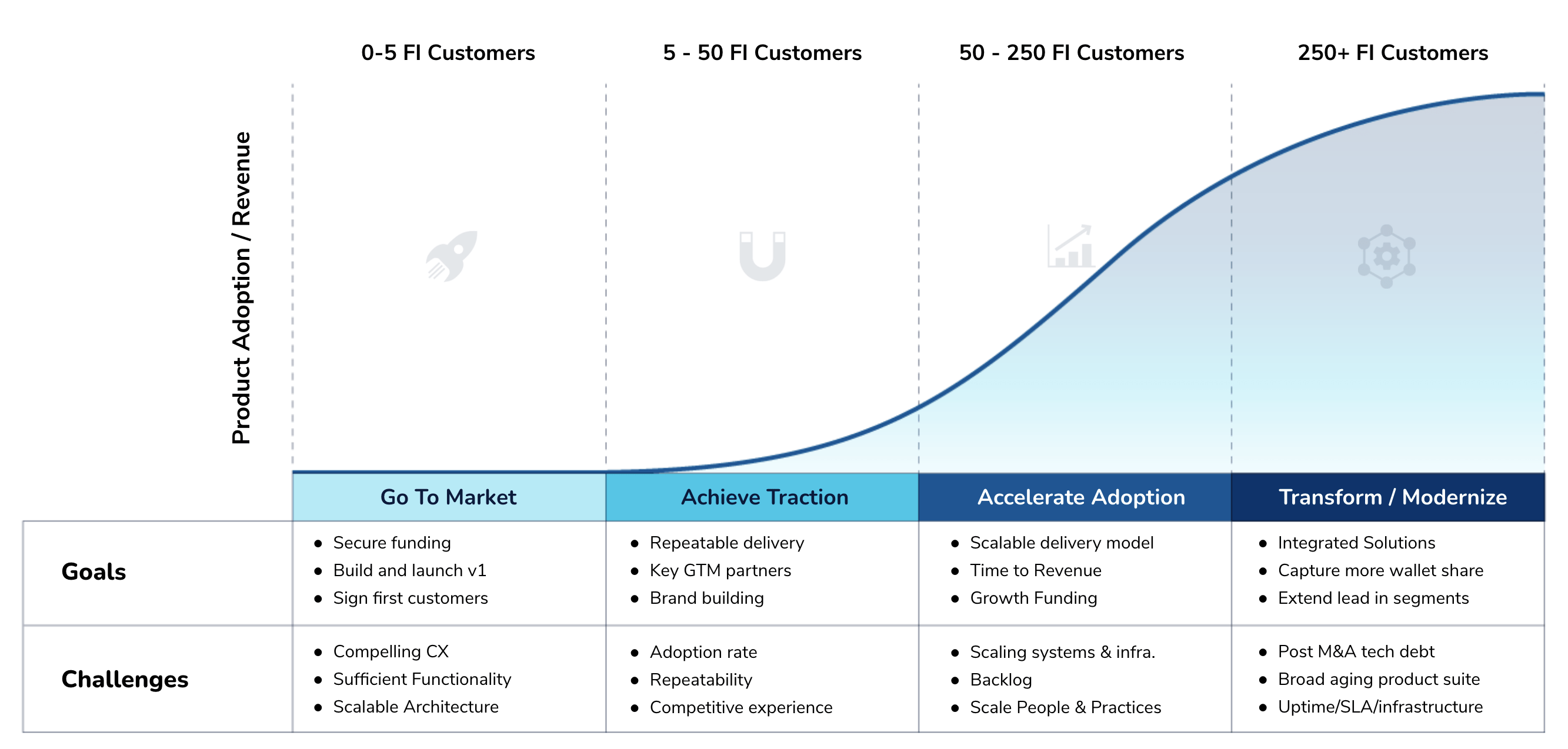

Every fintech product can be said to fit into a particular stage of the software adoption lifecycle. Established fintechs with new products to offer and recently established fintechs still discovering their product-market fit, both share in the Go To Market stage of the software adoption lifecycle. Fintechs at this stage have a compelling, primarily pre-revenue product built and ready to ship — and much of the focus is set on making sales. But CX may present significant challenges to both sales and long term growth.

The CX Challenges of Go To Market Stage Products

Products just barely on the market typically experience low adoption rates. Praxent finds that many fintechs at this stage are unlikely to have settled on their product-market fit — with little in the way of sales just yet, they also have little to go on in terms of indicators. The sales environment amongst fintech software providers is excruciatingly competitive, whether as a startup or an established brand, making the need for advanced digital CX even more salient. A product at this stage needs a competitive differentiator — and digital CX has become just that. While many companies purport to offer a great CX, not all deliver. How have fintech leaders attempted to solve this CX excellence gap?

Solutions Used to Address CX Challenges – And Their Outcomes

Many fintechs rely heavily, even entirely, on their internal teams to help fill in the gaps ad-hoc. Fintechs may also rely on their existing software development partners in order to augment their teams as needed. Between limited funds and the need for domain expertise, this is often seen as the only solution for early stage fintechs. However, product executives we’ve worked with warn that relying on internal teams alone can lead to distraction of core development and engineering leadership from product roadmap items. This, in turn, can lead to missed revenue targets and poor product performance. Leaders who turn to their software development partners indicate that while initially a convenient choice, it can also manifest in poor product CX differentiation. When this happens, they receive an increase in client complaints about the lack in customization and brand support. It’s a fix, but is it a truly customized, exceptional CX? Likely not if the product resembles the clients’ competitors’.

Taking a different approach, other fintech leaders may end up hiring expensive consultants who, in many cases are stellar strategists, often don’t have ‘boots on the ground’ knowledge to actually execute on the strategies that they recommend. For a development team to succeed, they need a rock-solid strategy — one that includes in-depth implementation support and guidance. When a consultant can’t fully deliver on this need, the result is usually a high-cost, impractical, unrealized CX solution. The momentum needed to shift a new fintech product from pre-revenue to highly competitive is just not quite there without that critical combination of CX strategy and development skills — and this disconnect results in suboptimal business and technical impacts.

No matter the approach to CX challenges, fintechs across the entire software adoption lifecycle will find that some solutions amount to little more than front-end band aids. These quick, cosmetic fixes don’t address deep, holistic CX issues and often result in technical and design debt. But the worst resolution? Giving into misalignments between business and technical teams and doing nothing at all. Fintechs that avoid their CX issues ultimately push the problem onto the FI client, making a product the opposite of a valued response to a market need. The ripple effect is profound, impacting the clients’ customers, and coming back around to impact the fintech in the form of unhappy clients, reputational damage, underwhelming adoption rates, and high loss rates for new sale opportunities.

A Better Solution

Rather than tackling any singular CX issue head on, top performing fintech leaders look at CX in a far more holistic way by addressing:

- The core product CX

- Customizations that support personalized CX and FI brand support

- Understanding and addressing how both FIs and consumers use and engage with the product

- CX as a function of system performance, stability and scalability across the entire ecosystem

- Alignment between internal business and technical stakeholders

- How to identify and track key metrics for CX success

To clearly address the CX challenge and design its solution, fintechs need an outside perspective that is rooted in deep domain expertise and built upon a tested methodology that is both quick and affordable. Why the outside perspective? Simply put, the internal team may be too close to the product to accurately see all of it’s problems. An outside perspective will remove key CX issues and build confidence in the product before investing in development and ensure a higher adoption rate. Particularly when a fintech product is new to the market, limited adoption could delay market feedback on the product’s strengths and weaknesses, costing valuable time in the race to gain market share. Fintechs need a shortcut to acquire this perspective as quickly as possible before the window of opportunity for the product closes.

Our Approach

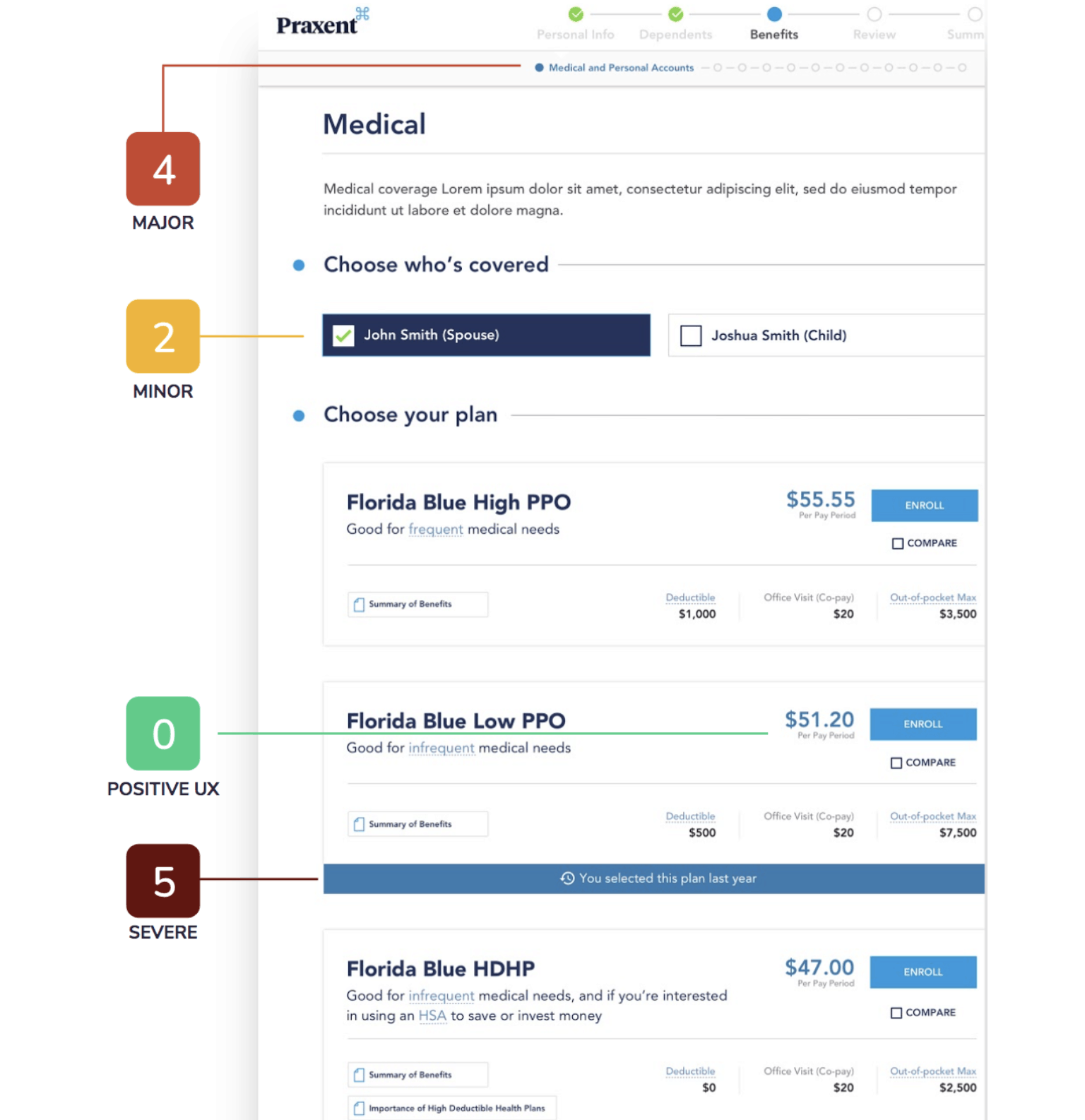

A CX audit, or heuristic evaluation, is grounded in logical best practices for identifying gaps in the user’s experience. The CX audit process builds definition around CX issues in a product that can’t always be seen by product insiders.

As a deliverable, the report defines these priorities in a list of items to take action on, revealing broken experiences, critical issues, accessibility concerns, cosmetic areas for improvement, and other areas of friction for clients. Painstakingly sifting through a workflow, Praxent identifies points of friction rated on a scale of 1-5 in terms of their gravity to deliver a prioritized list of action items.

With the help of an external CX evaluation, product owners benefit from an objective, logical perspective that roots out problems and improvement opportunities they may be missing.

The Results

An approach rooted in an impartial, expert third party evaluation, results in an excellent customer experience. When the changes recommended in a CX audit are implemented, new fintech products and startups develop intuitive, out of the box experiences for their consumers. The core fintech product becomes optimized for a trustworthy, consistent, personalized CX with a lowered support load. With this increased trust and customization comes a more competitive product — leading to faster new customer acquisition and higher conversion rates.

“ I was looking for an improved look and feel for our user experience. Our platform was externally facing, so end users were interacting with something that was dated and difficult to use. My main goal was to improve it—at minimum, bring it up to par, ideally, improve it beyond table stakes for the industry.

“The problem was, we had bolted on additional functionality as we needed it. It ended up being a conglomerate of things that didn’t flow well, even though all of those things were still needed.

“I needed help. I didn’t have enough knowledge of best practices and heuristics for user experience to be able to apply them to our process. I think that was my biggest concern—not just giving the platform a facelift but actually improving the functionality of it.

“The team at Praxent told me the top five things we should be doing to improve user experience. They listed major, high-impact things but also low-hanging fruit that could be fixed without pulling everything out by the roots and starting over again. I trusted they understood and were experts in UI/UX. I also trusted their project management expertise and the plan they had for how to move forward. Choosing them was a no brainer.”

– Praxent Client – SVP Strategy, Benefits Enrollment Platform

Interested in learning more? Talk to a Praxent expert about how your fintech can implement a CX audit and overcome the CX excellence gap that’s holding you back from growing your business.

Speak to an expert

Leave a Reply