9 min read

CX Design Delays at Accelerated Growth Fintechs – How to Keep up with the Competition

CX Design Delays at Accelerated Growth Fintechs – How to Keep up with the Competition

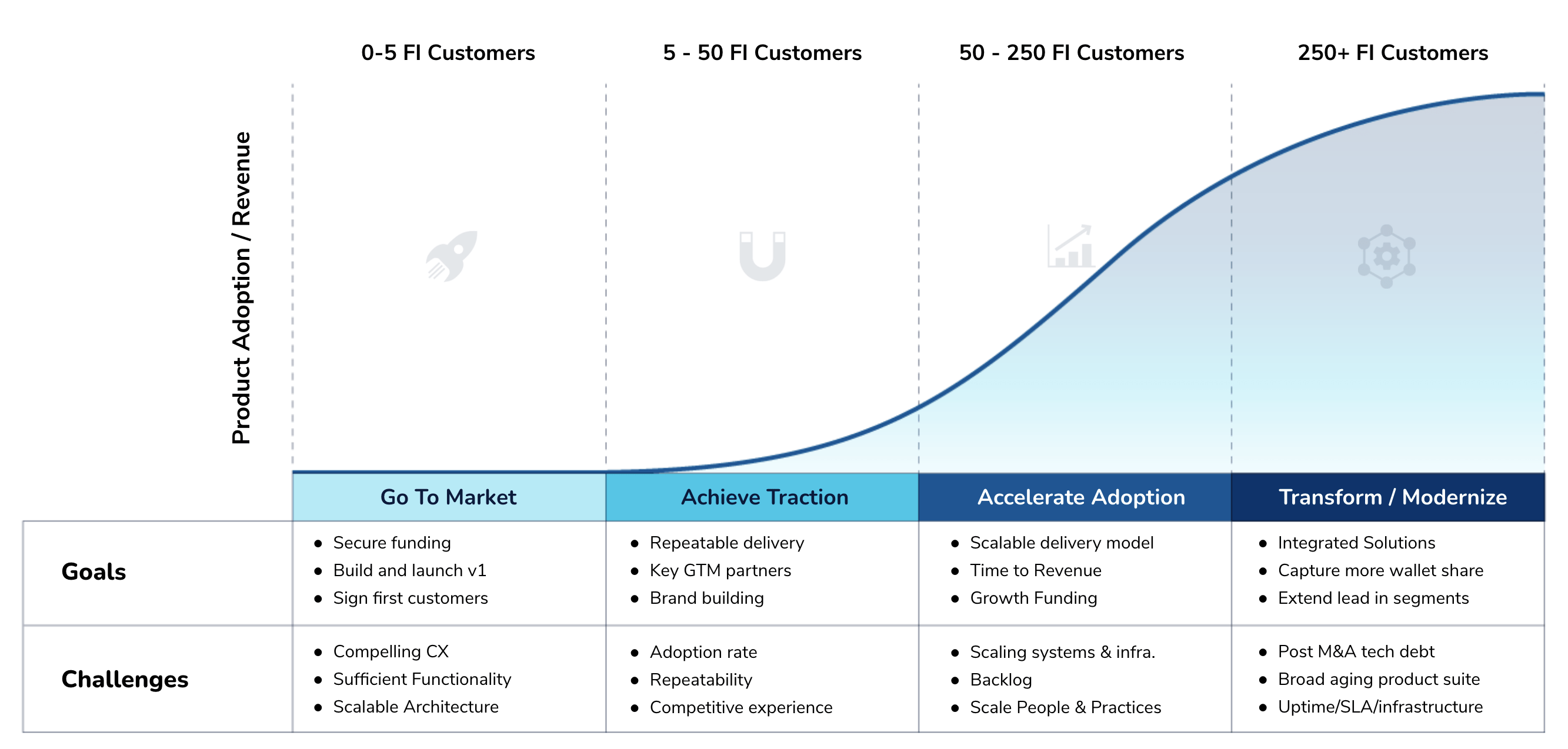

Understanding how the unique CX challenges for fintechs in the ‘Accelerate Adoption’ stage of the product lifecycle impact FI sales

Somewhat established fintech companies that have found their product-market fit and seen some long term consistency in sales are in the Accelerate adoption stage of the software adoption lifecycle. At this stage, while their product is gold, it’s certainly not without its limitations — in fact, some key limitations may be holding them back from beating out the competitors and gaining a fuller market share.

The CX Challenges of Accelerate Adoption Stage Products

In the acceleration stage, the race is on to beat the competition — and fintech leaders simply can’t deliver fast enough. Praxent has spoken with product leaders at this stage who frequently note struggling to deliver on product features quickly enough, as well as making the implementations necessary to capture all the opportunities they see. They may also be struggling to bring in all the talent needed to sustain their rapid acceleration.Basically, acceleration is both a major priority and a major challenge.

Part of this dual success and challenge lies in the recognition that digital CX excellence is a key competitive differentiator. Like so many other aspects of the acceleration stage, fintechs here just can’t seem to stay ahead of the top CX movers and shakers on the market. The sales environment amongst fintech software providers is more competitive than ever before, and it’s nearly impossible to keep abreast of all the moves competitors make. There’s often an imperative to move quickly, but doing so risks design and technical debt, not to mention all the snowball effects that tends to bring about.

Solutions Used to Address CX Challenges – And Their Outcomes

Stepping back and providing extra space for resolving product problems is useful. But in order to do so, leaders need the time and resources to give their internal team that extra capacity to think more deeply about their products. This thoughtful approach is exactly what’s needed to help raise the digital CX bar of excellence — but with time and resources in such short supply, compromises are, understandably, often made.

Many fintechs in the acceleration stage come to over-rely on their internal teams, attempting to fill in the gaps ad-hoc while the design team doubles down on the major CX issues at hand. But in Praxent’s experience, this approach can challenge even further — with such high competition, teams can’t move quickly enough, and doing the best they can, feature gaps quickly present themselves. Soon, the product falls behind, with lower quality CX, uneven, inconsistent, and friction-laden features. This leads to missed revenue targets and losing sales to better products, as well as discouragingly slow deployments due to large backlogs for the internal teams to rush to complete.

This entire approach rubs off on the customers, too, and fintechs at this stage are bound to hear reports of unhappy, underwhelmed customers who’d prefer to see evermore rapidly responsive customization and brand support than they’re able to deliver. Between a slow time to revenue realization and perceptions of a subpar product performance, misalignment between internal technical and business teams is bound to grow, as a reputational impact takes its toll. Simply put? Acceleration is a sensitive process — too fast, and the accelerating fintech has introduced more problems than they had to begin with. Too slow, and the CX is just not going to cut it in today’s market.

A Better Solution

Innovative fintech leaders may come to rely on third party designers in order to execute on customized solutions and deployments. This approach can make or break a company — choose the wrong partner, and you’re stuck with high external labor costs and time wasted bringing the partner up to speed on the intricacies of the fintech industry, on top of all the slow growth and missed opportunities of the internal approach outlined above. But by choosing a partner who views CX in a holistic manner, with a tight methodology and deep fintech and financial services domain knowledge, these roadblocks can be prevented and acceleration can occur without affecting an internal team’s velocity and focus.

When looking at potential third party partners, ensure that they support:

- Customizations that support both personalized CX and FI brand support

- Understanding and addressing how both FIs and consumers use and engage with the product

- CX as a function of system performance, stability and scalability across the entire ecosystem

- Alignment between internal business and technical stakeholders

- Identifying and tracking key metrics for CX success

- Utilization of empirical frameworks to analyze product CX

To truly move fast and keep up with the competition needed, an accelerating fintech need to give their internal team the focus to think holistically about the product and it’s future. In order to do that, a successful external team partnership is needed, one that will result in the fintech gaining the capacity needed to supplement and reinvigorate their team’s CX design practice. Here’s the particulars of how Praxent can help accomplish this.

Our Approach

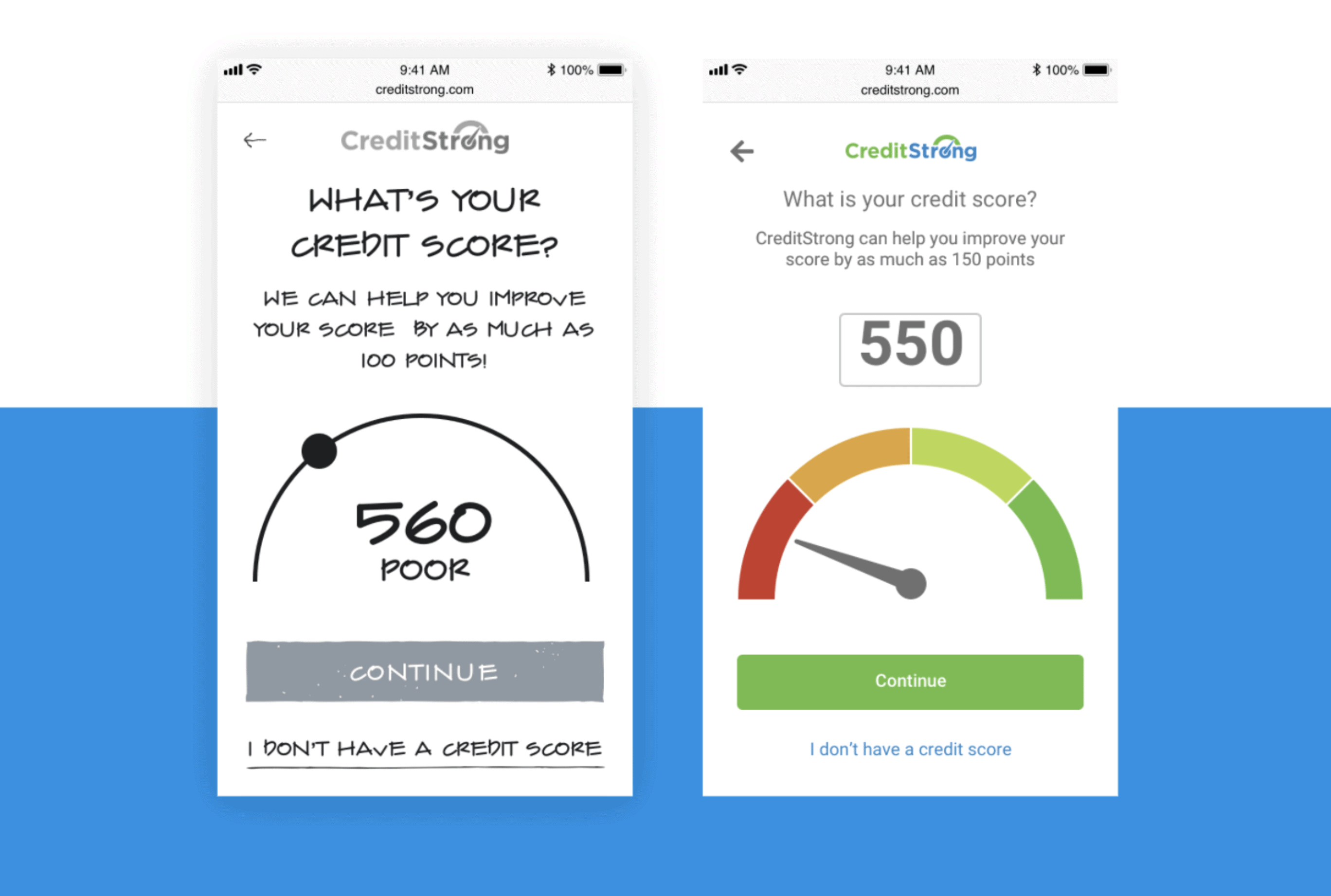

Praxent’s specific approach to supporting the acceleration of fintechs centers on enabling them to invest a small amount up front to test the waters of our partnership before investing fully in an ongoing design partner. Praxent does this by offering a Trial Feature Design and creating Digital Style Guides. During a Trial Feature Design, a client is enabled to trial outsourced designers –without distracting their internal team:

- The client receives a block of 40 design hours from our expert fintech CX designers over the period of 2 weeks. Praxent takes on a key feature from their backlog and delivers a wireframe design for client approval in week 1, followed by a high fidelity design in week 2.

- The client can then test out Praxent’s design skills before setting us to work on the next feature, or before integrating Praxent designers with their internal team to increase design velocity.

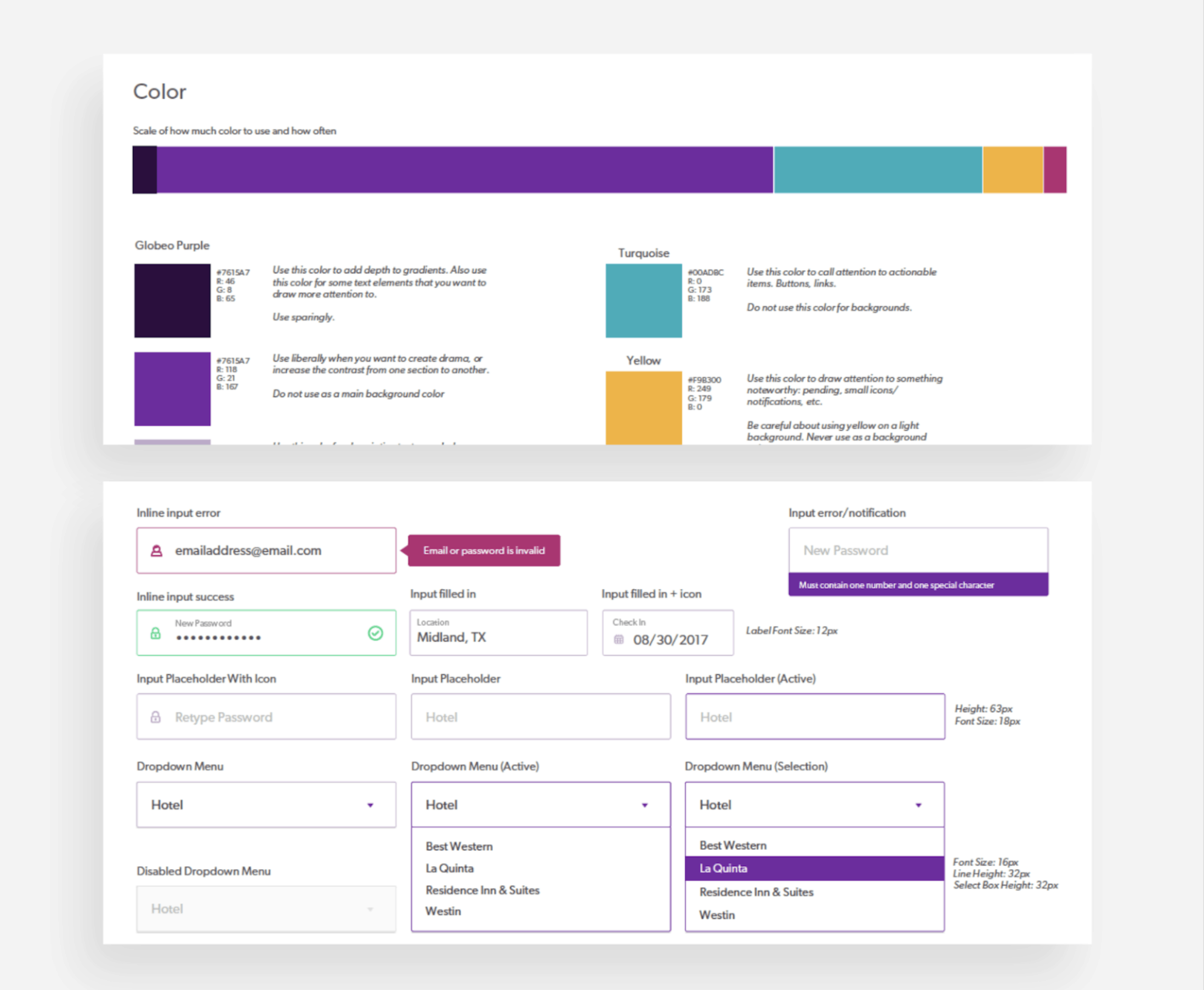

Praxent also provides Digital Style Guides which enable clients to create a design practice within their organization, maintain design standards, and ensure a consistent CX:

- We’ll audit an existing product and within 2 weeks, develop a style guide in Sketch, InVision, and PDF format for design team approval.

- The guide will encompass every object designers need to create a consistent UX from button styles to table formats color schemes

- With the completed guide the development team can take the designs and build out templates for every object, ensuring consistency across the entire team.

The Results

In trialing outsourced team augmentation, fintechs are able to take inexpensive, high leverage steps towards an accelerated CX with their products. With trusted CX design partners at work, these fintechs see less distracted internal teams, faster product roadmap execution, better engineering efficiency, more internal alignment, and ultimately, a faster time to market with smaller backlogs for their internal teams.

Down the road, Praxent sees that this supports a better long term system performance — and a more competitive product that stands up to the market. With higher conversion and retention rates and deeper brand support for financial services customers, these fintechs are bound to see customer success, retention, and acquisition rates rise. With a quicker rate of revenue growth, they can (and should) continually invest in the upgrades necessary for delivering a consistently high quality CX as users traverse systems and integrations.

What Praxent Clients Have to Say:

“I’ve been impressed by how they managed our two main priorities: getting to market quickly and improving the features our participants can engage with. They have a really good design team. I’ve been impressed with how well they can take our ideas and put them into action. They’re creative, they hear our feedback, and they come up with unique ways to present data and create an experience on the platform.”

– Suzanne Werner – Executive VP, BlueStar Retirement

“The Praxent folks understood continuity, consistency; and a lot of their clean up changed it to move it in a consistent direction. It sounds very simple, but it was an extremely important part of how the platform needs to function. So they definitely took us from a lot of not necessarily consistent approaches to a much more consistent approach, a much more user-friendly workflow.”

– Timothy Humphreys – Managing Partner, Procella Health

Interested in trialing a design team to leverage your internal capabilities? Talk to an expert about how your fintech can accelerate its CX design in a low-cost, high-impact way.

Speak to an expert

Leave a Reply