4 min read

How firms like Quora scale to billion dollar valuations

How firms like Quora scale to billion dollar valuations

Q&A site Quora, launched in 2009 by former Facebook execs Charlie Cheever and Adam D’Angelo, has quickly become the 140th most-trafficked site on the internet (out of an estimated 1 billion total sites). It’s also one of the most highly valued, with $160M raised in funding and a valuation of $1B. And that’s all before generating any revenue or creating any content.

Actually, Quora will never create content. Its users do that, through crowd-sourced questions and answers contributed by experts. And they do it for free, although Quora has begun to offer “Knowledge Prizes,” payments funded by companies for the best answers to especially valuable and relevant questions.

Quora is an example of a multi-sided platform, a business model that represents a fundamental shift away from the closed “pipeline” model of traditional companies. This shift was clearly identified in Platform Revolution by Geoffrey G. Parker, Marshall Van Alstyne and Sangeet Paul Choudary.

Listen to an interview with Marshall Van Alstyne from Platform Revolution

Listen to an interview with Marshall Van Alstyne from Platform Revolution

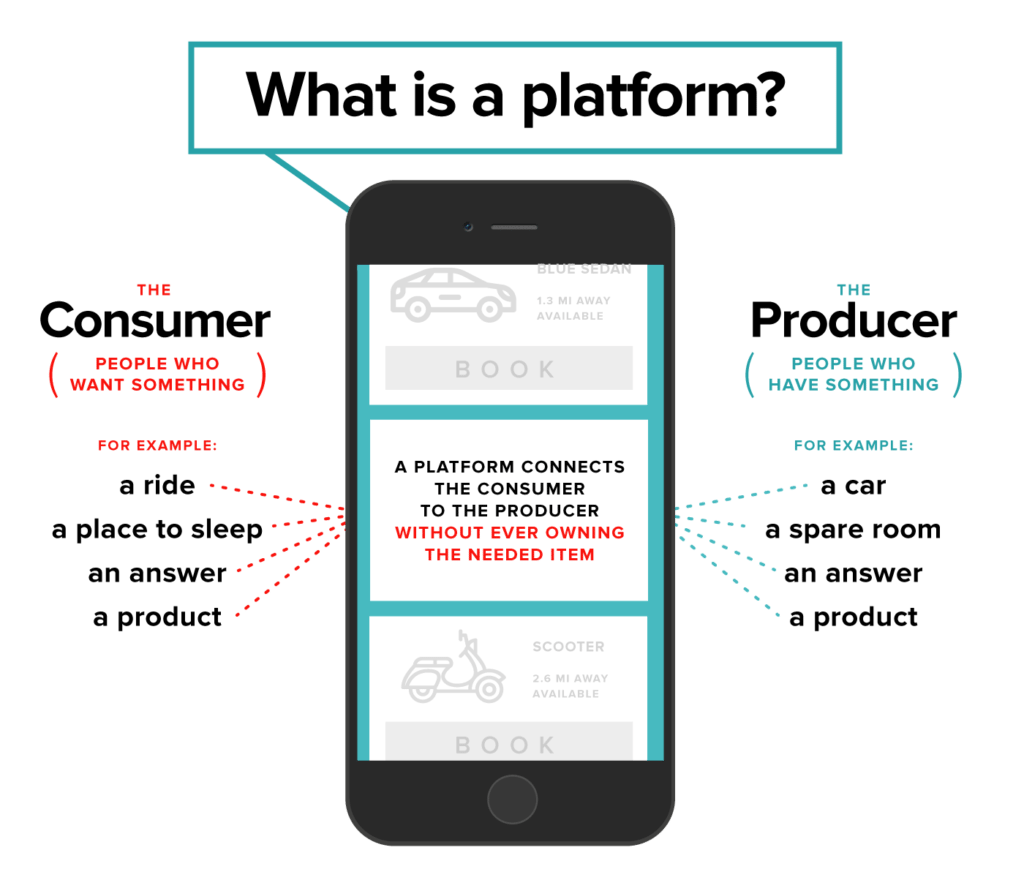

What is a platform?

Digital platforms connect people who want something — consumers — with people who can supply it — producers. What consumers want could be a room (Airbnb), a ride (Uber), a romance (Match.com and others), a career reboot (LinkedIn) or the best responses to almost any question you can think of, such as “What are the three best life hacks?” and “Who is the smartest person to attend MIT?” (Quora). The platform owner serves as a facilitator, leveraging goods and services outside the company to create value.

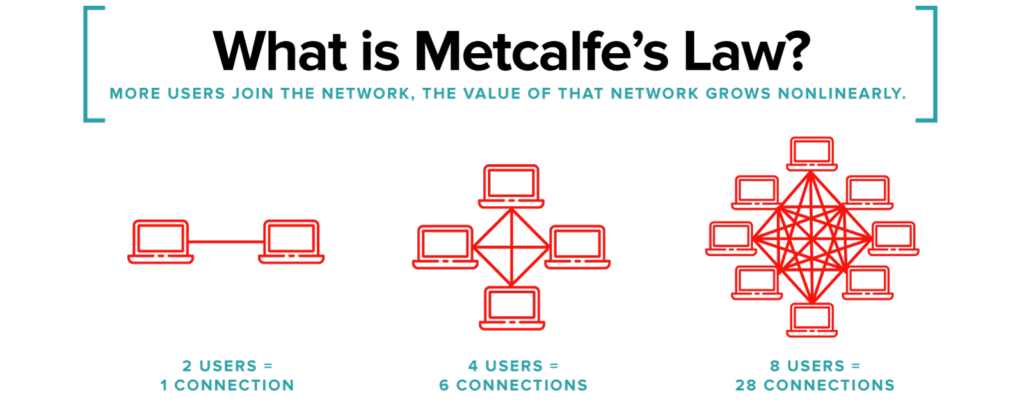

As more travelers use Airbnb, more producers add rooms, attracting more users, etc., in a nonlinear growth pattern Bob Metcalfe has identified as the network effect. Metcalfe’s Law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system: With 2 telephones, 1 connection is possible; with 4 phones, 6 connections; with 12, 66 connections; and with 100 phones, 4,950 connections . . . and so on forever.

The network effect makes platform businesses hyper-scalable because increased demand requires no new manufacturing or expansion of infrastructure. In fact, many platform businesses leverage assets that are underutilized. According to Geoff Parker, most cars are used only 5-10 percent of the time. Uber is simply using excess capacity, aka “leveraging abundance.”

So what does all this have to do with traditional businesses? How can they benefit? Not by trying to morph into a whole new model, but by incorporating a digital platform to offer new value.

The Platform Revolution authors point to John Deere, which collects agronomic, historical and weather data (some of it captured by sensors embedded in tractor cabs) and offers it to farmers through a platform and a mobile app for better-informed planting and forecasting. Nike has a digital platform that connects customers with a record of their fitness activities and the gear they prefer. 3DHubs.com connects 3D printer owners with potential users in 20,000 locations, spreading the considerable cost of high-end printers.

These intelligent solutions strengthen customer relationships, start important conversations and offer tremendous competitive advantage. They can also generate ROI significant in any business model. For our partner First Crush Tastings, we developed a platform connecting talented food-and-beverage ambassadors with tastings opportunities in the field. The result: 400 percent growth.

Liked what you heard on our podcast episode with Marshall Van Alstyne? Check out our other two interviews with Platform Revolution authors Geoff Parker and Sangeet Choudary.

Learn More

We’ve helped many other clients use technology to improve their businesses, and we can help you make the right connections to transform yours. Schedule a free consultation with our software development team.

Interested in learning how a digital product or platform could disrupt your industry? Sign up for our next free webinar.

Leave a Reply