11 min read

How to Do Practical User Research (Without Spending Thousands)

How To Conduct Practical User Research (Without Spending Thousands)

Praxent UX designer Nick Comito explains how companies can tackle user research in a strategic and cost-effective manner.

Don’t ask whether or not you have the budget to do user research on your next app or digital product. User research is not optional. But the good news is, it can be economical.

In this post we’ll explain the scale of practical user research, and outline 4 user research methods that allow you to execute on the recommended bare minimum to get the insights you need.

5 Tools for Fostering Practical Innovation

Ignite your organization on a path to innovative culture and design transformation. Simple skills, from guerilla research to helpful sketching exercises, can be easily learned and taught for wide impact across an organization.

Ignite your organization on a path to innovative culture and design transformation. Simple skills, from guerilla research to helpful sketching exercises, can be easily learned and taught for wide impact across an organization.

>>Access tools and ready-to-use templates. Download Deanna and Ryan’s 2019 IQPC Design Thinking conference presentation and field manual.

Companies that don’t do any user research at all create products built exclusively around their own business goals. Sometimes companies build anything that technology allows because it’s possible, and assume people will want it because it exists. Assumptions like this, made without a concrete understanding of customer needs, can be very dangerous.

User research is instrumental in building better, more informed products and achieving long-term success. Yet many companies shy away from it, thinking it’s prohibitively expensive. The truth is, you don’t have to break the bank identifying clear objectives for your product based on real user needs. In fact, you’re far more likely to break the bank if you don’t.

>>7 out of 10 software projects fail. Don’t let yours. Download our e-book Why Software Projects Fail to learn how to anticipate problems before they happen.

User Research Strategy: Place Your Project on the User Research Scale

It’s true that user research will cost you something. Think of it as an investment in the financial success of your product and your business. And consider the alternative – if the product you build doesn’t resonate with the people it’s created for, then developing it was a total waste of time and money because it won’t sell. User research is the only way to avoid this situation.

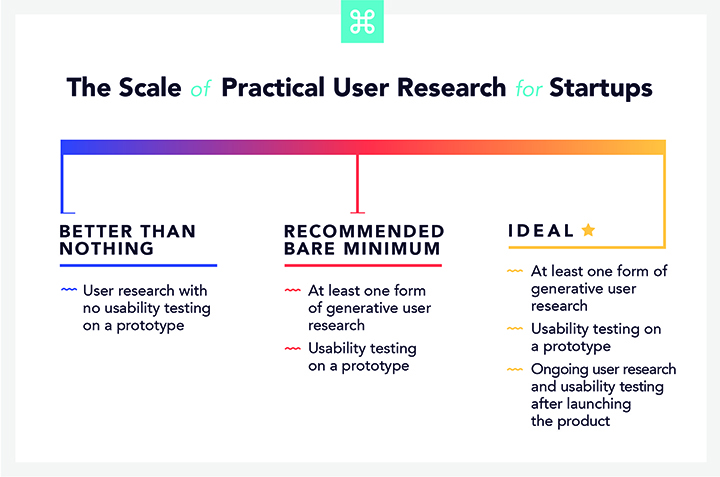

When we advise startups on custom software investments, we like to explain their options in terms of the Scale of Practical User Research. We recognize some businesses simply don’t have the budget to make large investments in user research, so we aim to provide user research methods across the resource spectrum, including cost-effective approaches.

On the far left of the spectrum you’ll find the least costly user research methodologies. These are better than nothing and can get the job done, at least enough to ensure your product won’t completely fail to resonate with users.

The right side of the spectrum represents massive amounts of user research, which provide enough insight for companies to deeply understand target buyers on a personal level. These researchers are able to get accurate, nuanced answers to questions about what motivates people to use a product and how that product can best meet or exceed customer expectations. They develop empathy for users as humans, making a huge effort to relate to the problems they experience and the contexts for which their product is intended.

Equipped with an ideal level of understanding, researchers on the far right end of the spectrum equip teams to build products supremely excellent at connecting with people and adding value to their daily lives. This is where the Walt Disneys and the Airbnbs of the world land. This is what sets the iPhone experience apart from its flip phone predecessor. Getting to this level isn’t automatic. It takes passion and desire for understanding your audience and how they behave. It also takes a big budget.

While the most affluent and ambitious companies land on the right side of the spectrum, the reality is that not everyone is Airbnb, nor do they need to be. Any progress along the Scale of Practical User Research will influence the success of your project, and conducting SOME research is always better than conducting NONE.

So let’s take a look at some practical ways to implement user research strategy in a cost-effective manner that still gets the job done.

The Recommended Bare Minimum: Generative User Research and Usability Testing

Getting accurate answers about why and how people will want to use your product is not always as straightforward as a survey can make it seem. Sometimes you need a deeper, more human element to the information you collect.

Combining generative user research methods with usability testing on a prototype is a cost-effective way to get to the bottom of why and how people will use your product. It also answers the upfront question of if they will even use it at all. Usability testing refers to real-life user research on an actual product. Generative user research is a preliminary method of investigation which provides insight into user needs and desires before you invest in building a prototype.

Find out what you can about how your target users would relate to your product through surveys, interviews, or other means. Then design your product in a way that will solve their problem satisfactorily, based on your current understanding of what that looks like.

Turn your designs into a prototype. Then find 5 people who match your provisional personas (or your current, evolved understanding of who your target users are) and have them use the product.

Categorize and measure your test users’ experience with the product, and search for concrete conclusions about what your product needs to do and how it can best meet expectations.

The User Research Process: Getting Started with Generative User Research

There are some types of generative user research methodologies that have the potential to make a huge difference in the success of your product, all of which you can do on a dime.

Step 1: Create Provisional Personas

The most effective generative user research involves connecting with real people in real situations. Instead of talking to any person you can find in the construction industry, strategically narrow down your search (and save time) by creating provisional personas.

Provisional personas are profiles about who you think will use your product and how you think they will use it. Create provisional personas before you begin the process of user research, and be sure to update them as you go. Your understanding of who will use your product and why will likely change the more you talk to real people.

Step 2: Choose a Research Method

Now that you have an idea of who you want to research, it’s time to make a plan for how you will conduct that research. There are several user research methodologies which can be conducted no matter the size of your budget.

Allow your budget, personal network, and target to guide your method. You may be able to conduct multiple forms of generative user research. Just remember, one method is better than none!

USER SURVEYS

User surveys are one of the most common, easy, and practical forms of user research available. While we don’t recommend user surveys as a stand-alone method for conducting user research, they can be helpful when paired with more in-depth investigations. They are also cost-effective.

User surveys allow you to collect quantitative data about people. If you have an existing product you’re trying to re-create or improve, you can survey actual people who have used or are currently using the product.

If you are building a new product and you don’t have users yet, you’ll want to conduct surveys with individuals that match your target audience. This could include people using a competing product, or a defined category of people within an industry. If you’re trying to create a product that helps sales teams at construction companies, for example, you’ll want to conduct user surveys with people who match that demographic.

Ask survey questions with yes/no or multiple choice answers so you can analyze the collective results. Do your best to write questions that test whether your assumptions about target users are true. If you think the primary function of your construction sales app will be to eliminate the amount of paperwork sales representatives have to fill out, ask questions in your survey that verify whether this is truly the primary need.

USER INTERVIEWS

Collecting quantitative data through user surveys is great. But it can be limiting, as there is always more detail behind a yes or no answer. Adding interviews to your user research process helps go beyond the surface and gather deeper, more valuable insights.

To conduct user interviews, find 5 or more people who closely match your provisional personas. Next, carefully craft a list of questions that not only validate whether your assumptions are correct but open up the conversation to discover deeper insights. We recommend using the Jobs to Be Done interview framework to guide the conversation and help interviewees process their thoughts.

CONTEXTUAL INQUIRIES

Contextual inquiry is a key user research strategy that allows you to not only ask people about their experiences, but also observe their behaviors in the context of using a product.

For instance, using the construction sales software example, a contextual inquiry might involve visiting a construction sales office or shadowing a rep matching your provisional persona. Document how they spend their time on tasks related to your product idea, the problems they encounter and how they approach solving these problems.

While it’s important to have a clear idea of what you need to find, remaining open to discovering new insight is equally as important.

Contextual inquiries don’t have to be hard or expensive. If you have contacts in your target industry, maybe they’ll let you visit their office or talk to an employee. Then you’ll only need to approach one or two others cold turkey to get a sufficiently well-rounded perspective.

COMPETITIVE ANALYSIS

In the absence of your own product prototype or in addition to prototyping, conduct user research on competitor products. This is a straightforward, low-cost user research method that supplements your information base.

-

- Put yourself in the user’s shoes. Try other products attempting to solve the same problem or related problems to what your product is trying to solve.

- Read as many reviews as you can about the competing product. Gather insight into pain points plus points of joy from this feedback.

- Investigate the financial success of companies selling competing products. Did they receive funding? Have they won Fortune 5,000 awards or been recognized locally for growth and revenue?

- Conduct usability tests on the competing product. Measure how long it takes for users to find what they need, and document the number of errors they experience along the way. You can use this information to figure out how you can make your product better.

As you can see, there are a variety of ways to conduct practical user research that will provide the valuable and necessary insight for success, no matter what your budget.

>>Want to know if your product will succeed on the market? From wireframes and clickable prototypes to usability testing and customer journey mapping, our UX design services have got you covered. Far more than just a design and build shop, we create digital products that help businesses scale and own the competition.

Free User Persona Templates in Sketch or Keynote

Learn how to distill user research into helpful visuals that convey clear meaning about product users. User personas are the ultimate tool for educating stakeholders and teams about the human-aspect of a project, while cultivating buy-in on design vision.

>> Download in Sketch or Keynote.

Leave a Reply