A case study by Praxent⌘

Modernizing the experience for an SMB lending platform

Velocity Solutions provides technology solutions for community banks and credit unions.

Praxent was engaged to redesign and develop a new user experience for Akouba, a digital lending solution. The redesign would drive growth by establishing the product as a market-leading, digital-first loan origination flow for small businesses driving increased conversions and self-service onboarding for institutions.

- SMB borrower and lender experience

- UX audit

- Usability testing

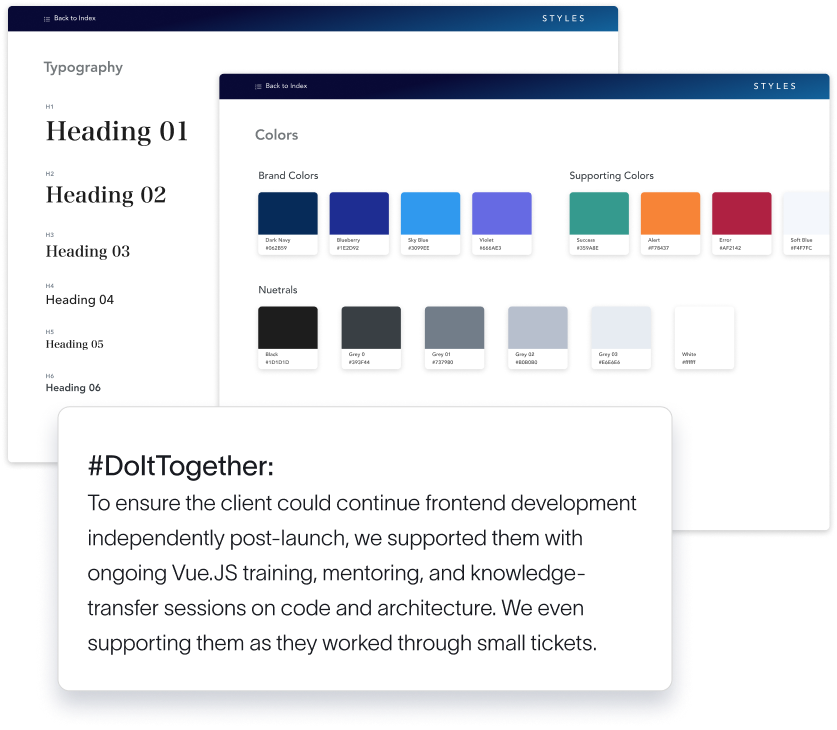

- White-label design system

- Codebase audit

- Technical architecture

- Frontend development in Vue.JS

- Program management

- Sales growth, selected by a Top 50 Bank

- 60% reduction in application flow length

- 32% fewer underwriting tasks

- Akouba is the only SMB LOS platform endorsed by

the American Bankers’ Association (ABA) - Launched within 6 months

The challenges

Loan application friction

The user experience was inconsistent, overwhelming, and unintuitive causing friction in the application process resulting in user drop-off.

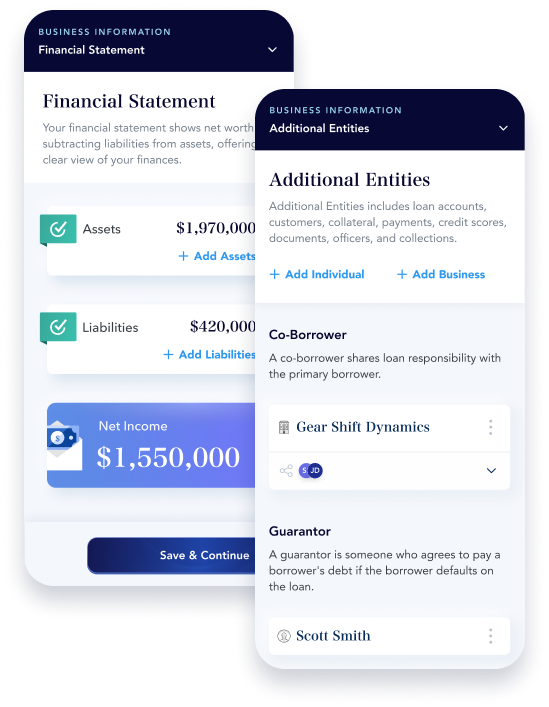

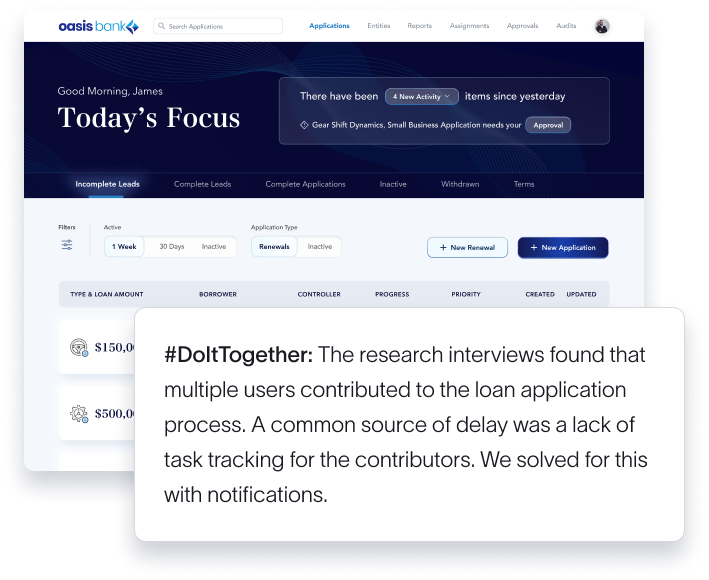

Multi-user applications

Multiple users in varying roles needed to contribute to each application process. Additional users needed to provide additional data, approve credit checks, sign declarations, and more.

Dated user interface

An outdated UI caused users to question the product’s security and abandon the loan application process. Additionally, the product struggled to compete with other digital-first platforms resulting in lost sales.

Unclear drop-off reasons

Users were abandoning the application process and stakeholders were unsure of the culprit. They needed clarity on the cause of the friction and unmet customer needs.

Frontend capacity gap

The client lacked modern frontend development skillsets in house and needed a team to collaborate and interface with their backend development team to launch.

ADA compliance

As the product was used by financial institutions, ADA compliance was critical.

The vision for Akouba

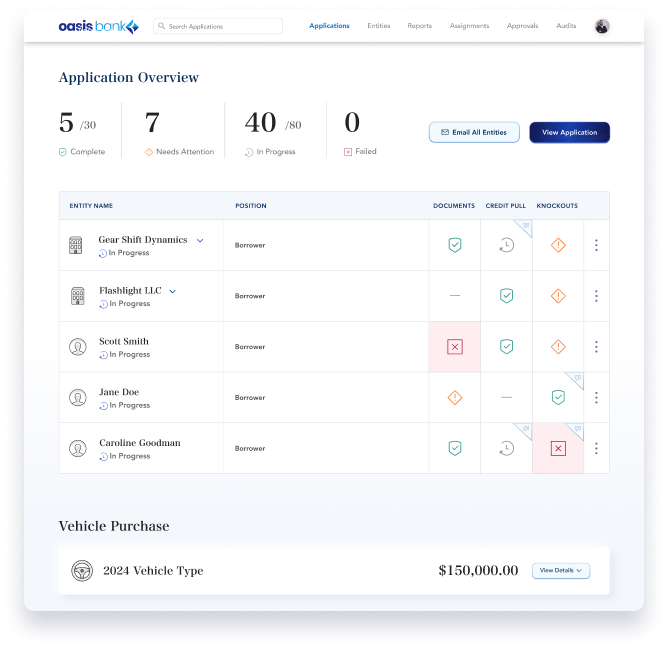

Streamlined lender approvals

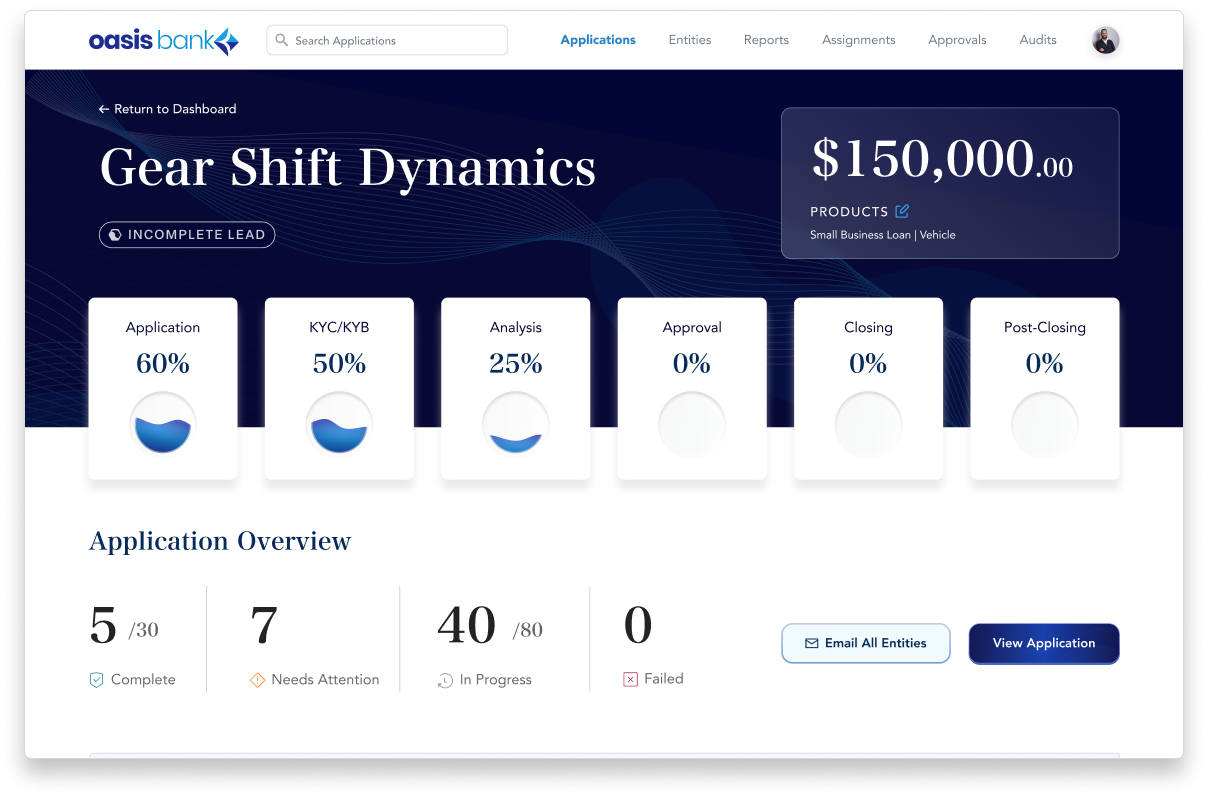

Significantly reduced lender workflow that reduces tasks and saves up to 50% of an underwriter’s time per loan – a big selling point for lenders.

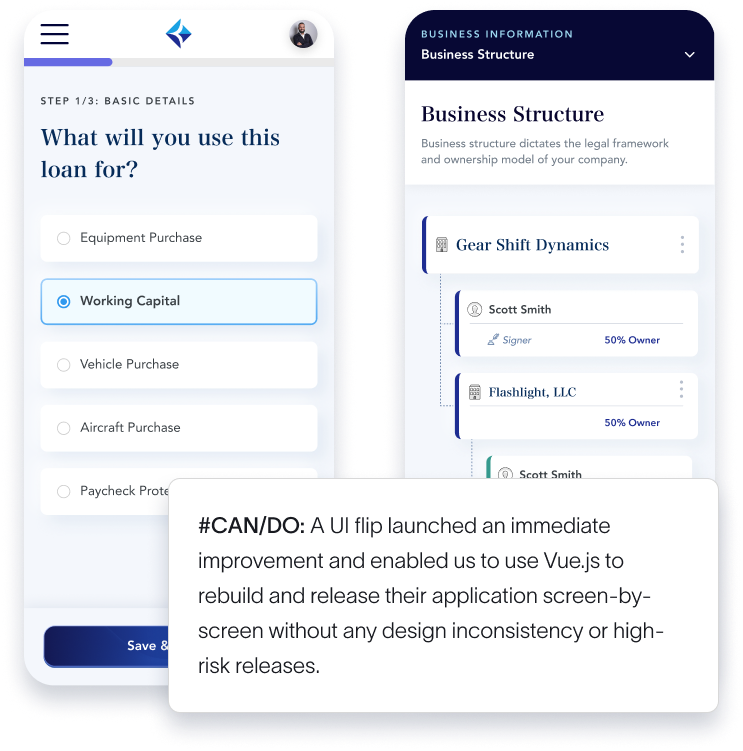

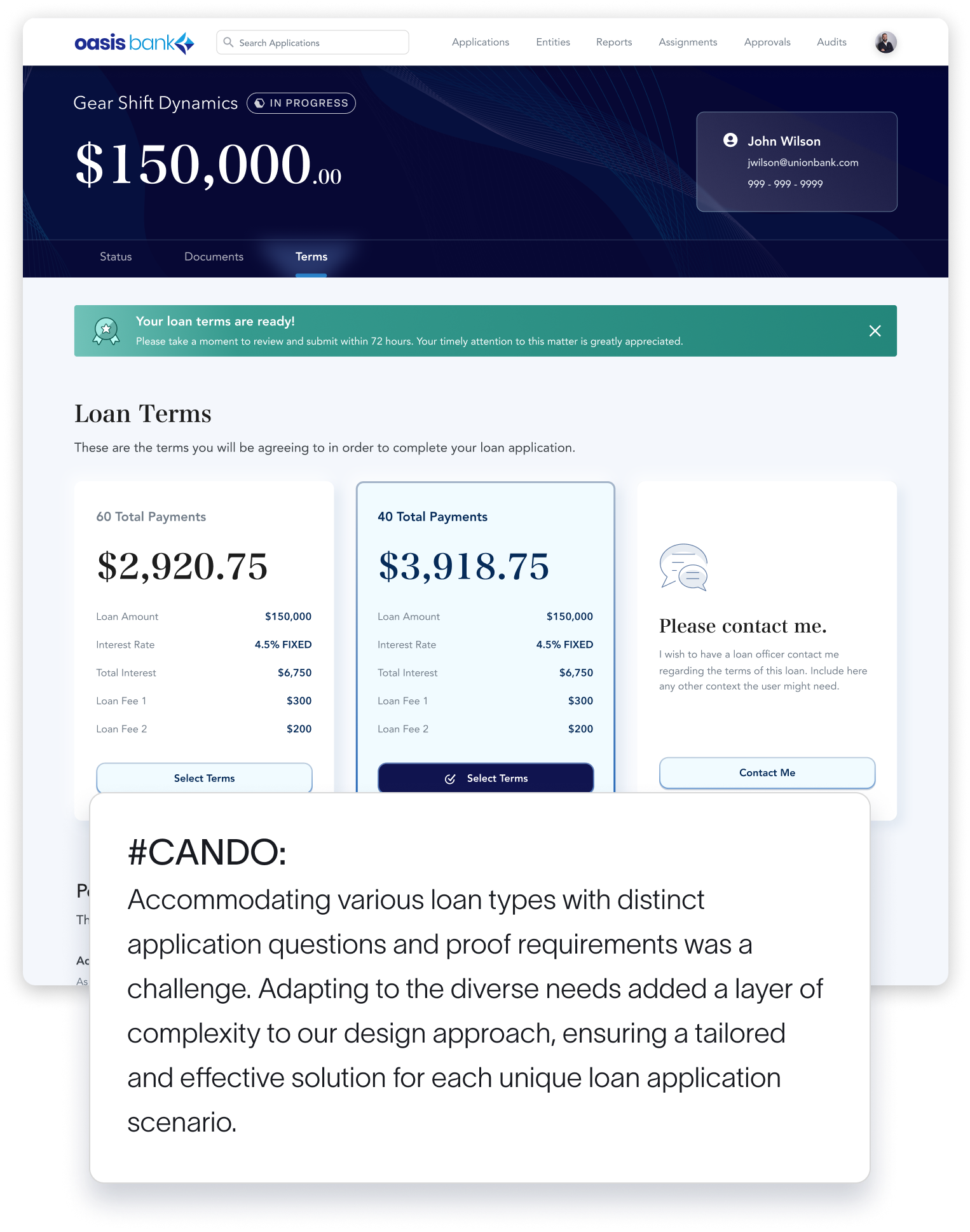

Intuitive loan application flow

A simple loan application wizard that makes applying for a complex SMB loan simple. Drives conversions and increases applicant self-service.

Vue.js iterative modernization

Rapid launch strategy with vue.js to enable isolated screen launches for an iterative relaunch over multiple deployments.

A partner from end to end

UX Audit and User Research

Identification of critical pain points in the process of loan origination.

Code Assessment

Code audit to identify technical debt, inform go-forward architecture and the modernization approach.

Frontend Development

Vue.js development of the frontend and collaboration with the internal backend team to launch.

Launch

Initial release for the borrower application within six months

UX and workflow efficiency in loan processes

Through User Research, we were able to identify a critical pain point for Velocity Solutions’ buyers. Speed to process a loan was a major value-add for lenders.

Based on this information we reviewed the design implications to deliver a refined workflow. The final product has 32% fewer tasks than the market average.

15+ years of experience in Product Design Specialized in Digital Experiences, Product Management, and Information Architecture

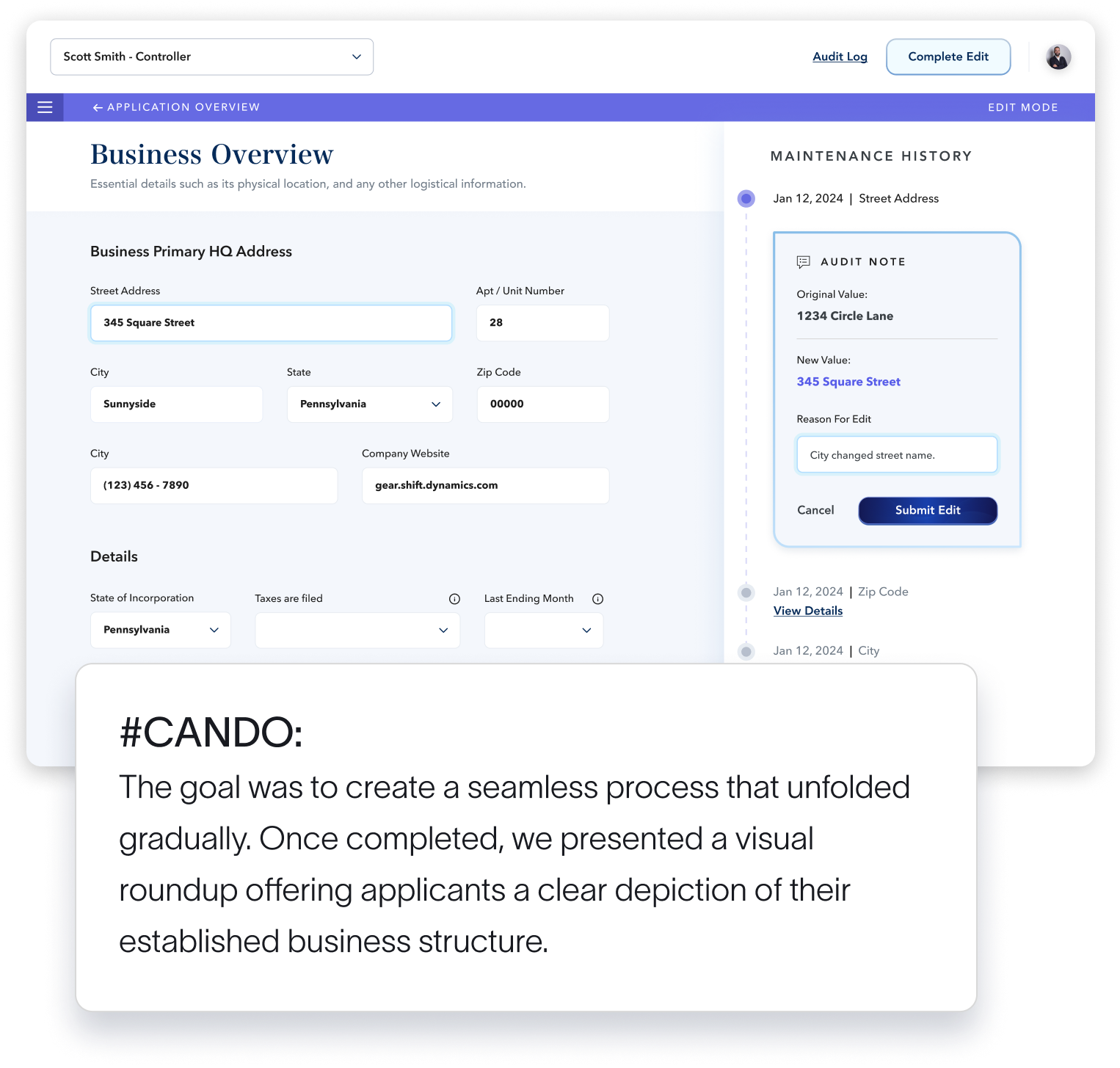

Hiding complexity from the end user

The most complex section for borrowers was the business structure section, requiring meticulous setup. Unlike some applications that might suffice with a top-level business structure, ours needed precision to better-inform underwriting. To address this, we crafted a guided experience, alleviating the pressure of figuring out the entire structure at once.

15+ years of experience in Product Design Specialized in Digital Experiences, Product Management, and Information Architecture

Delivering knowledge transfer across design and development

We led a comprehensive handoff and knowledge transfer process. On the design front, this involved setting up knowledge transfer meetings to meticulously review all raw design files and assets with the client.

The transition to the client’s designer was gradual, with Praxent providing essential support. Relevant design assets, including raw files and icons, were packaged and shared, laying the foundation for the client’s continued design expansion.

15+ years of experience in Product Design Specialized in Digital Experiences, Product Management, and Information Architecture

60%

reduction in application flow length

32%

fewer underwriting tasks

A fully redesigned user experience and user interface for Velocity Solution’s lending platform

Launched within 6 months

A note from our CEO

Tim Hamilton

Founder, and CEO Praxent