A case study by Praxent⌘

Embedded business banking launched

in 5 months

Youth sports leagues are a $37.5B industry in the US. They are heavily underserved in financial services.

Players Health and Thread Bank partnered to launch a custom digital experience offering specialized SMB banking + lending + insurance.

UX design

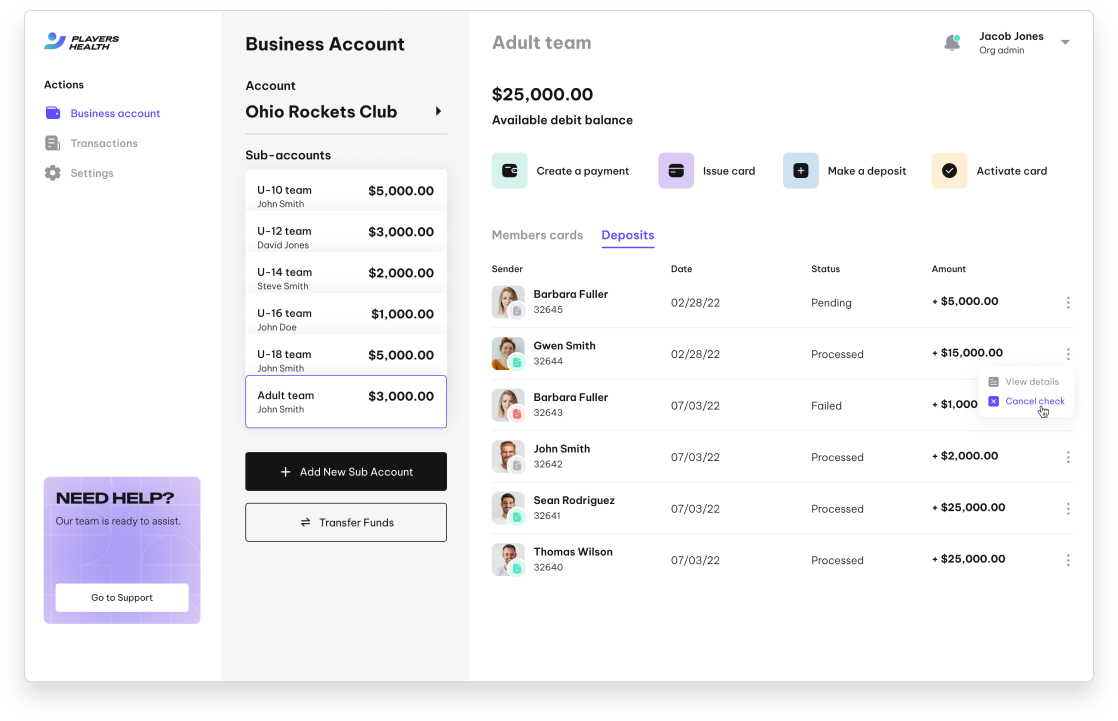

Full-stack development for:

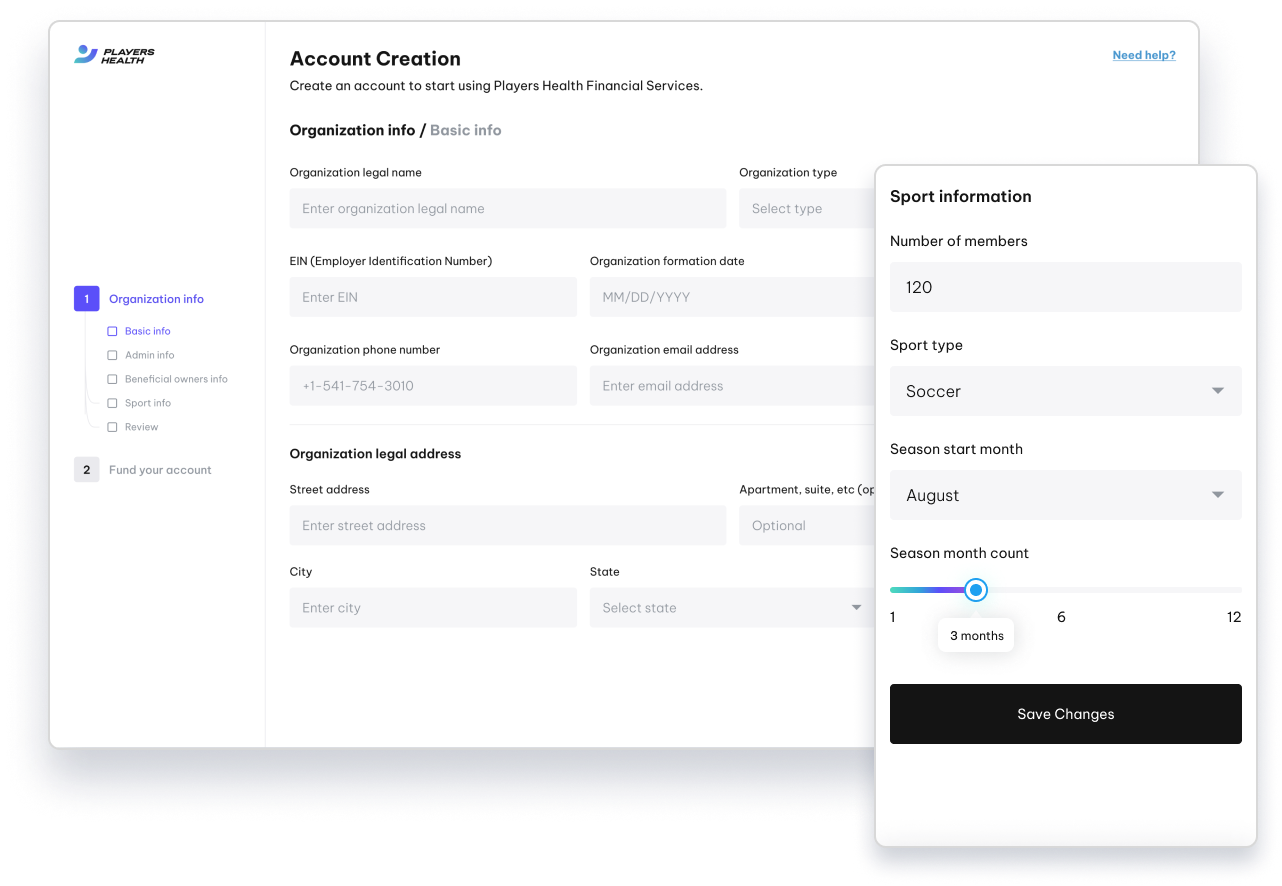

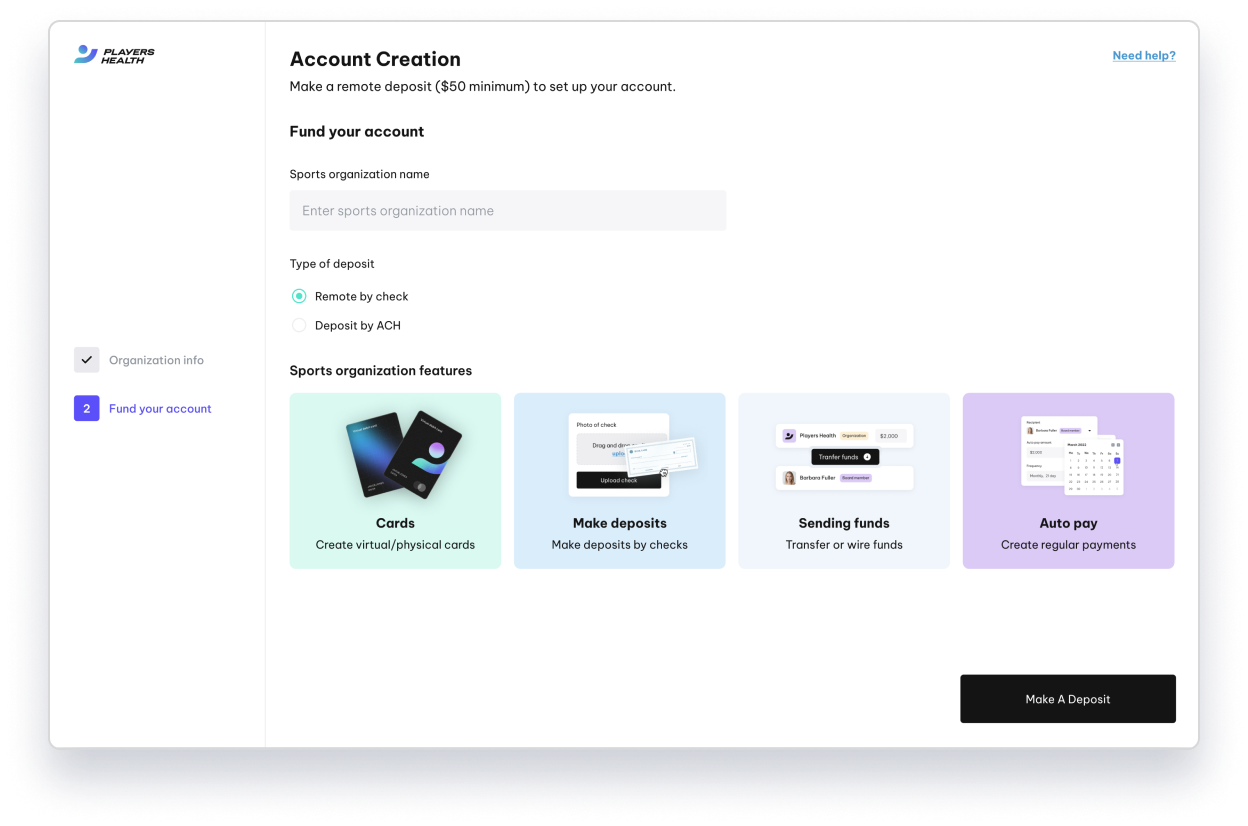

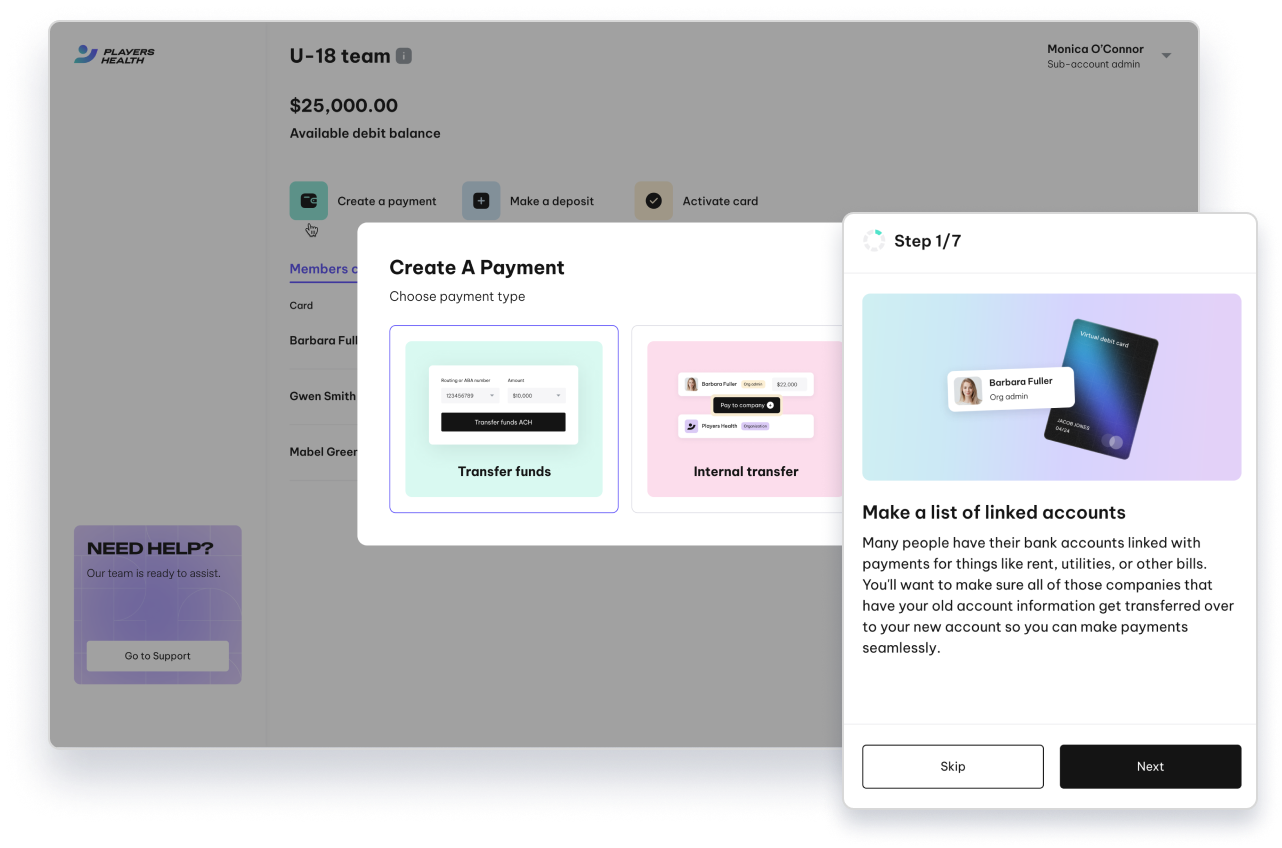

- SMB account opening

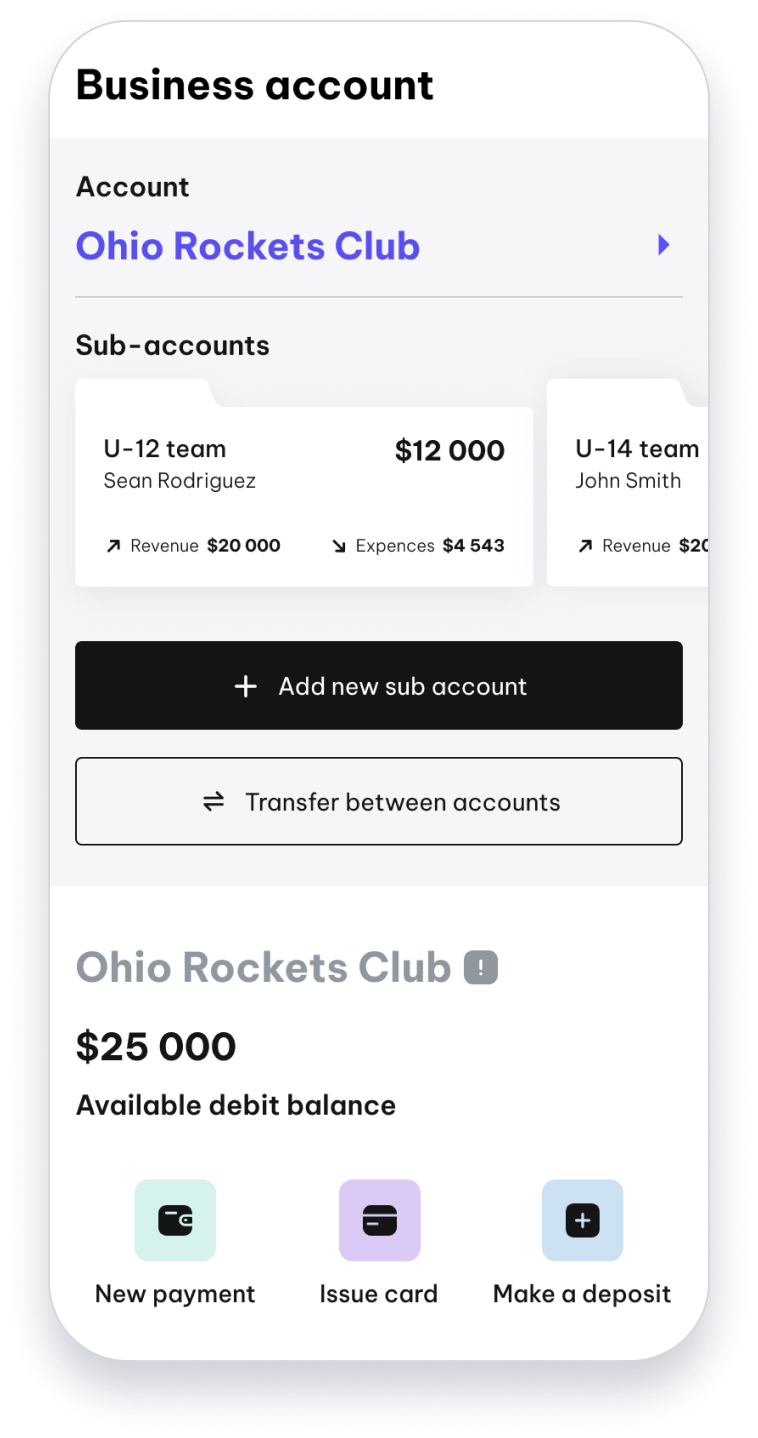

- Digital banking

- Corporate card management + sub-ledger

- BNPL purchases

- BaaS, card issuing + data provider integrations

- QA, DevOps, and compliance support

- <6 month launch

- 50+ SMBS onboarded in beta

- $600K ARR onboarded in week 1

- $30M Series B funding secured

The challenges

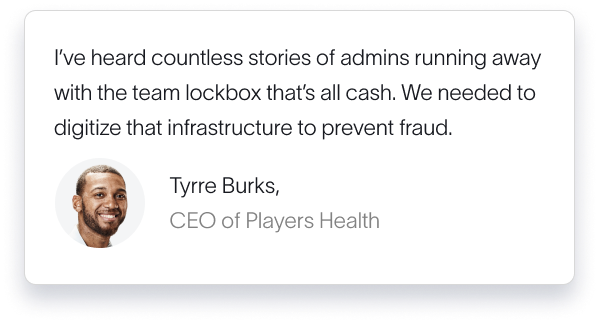

Fraud

Limited governance over funds often results in misuse that can be hard to track.

Upfront Expenses

Teams must pay for equipment and facilities often before player dues are paid.

Fluctuating balances

Seasonal cash flow often limits their ability to access capital.

Accounting

Tax, accounting, and board reporting is time-consuming and complex.

Multiple users

There are multiple teams per organization, each with coaches + admins requiring access to funds.

Vision: Players Health Finance

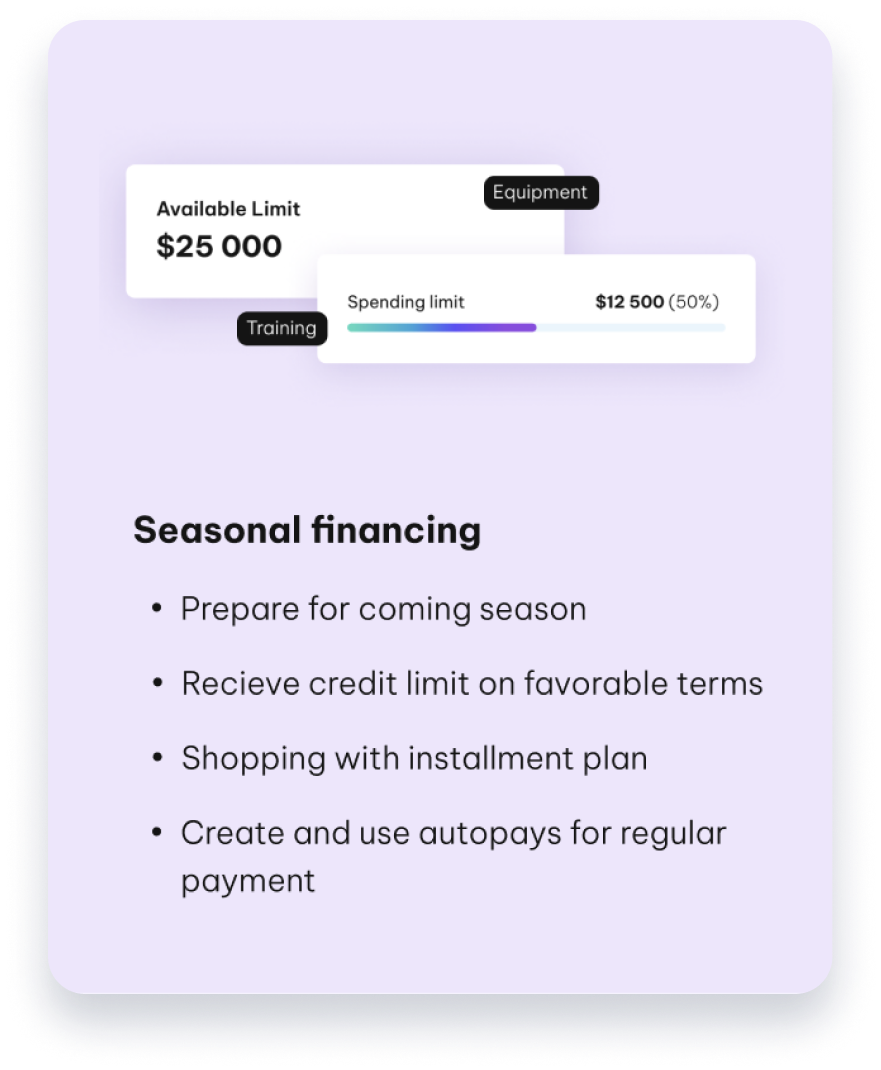

Pre-season advances and lending

To start the season with all of the equipment needed.

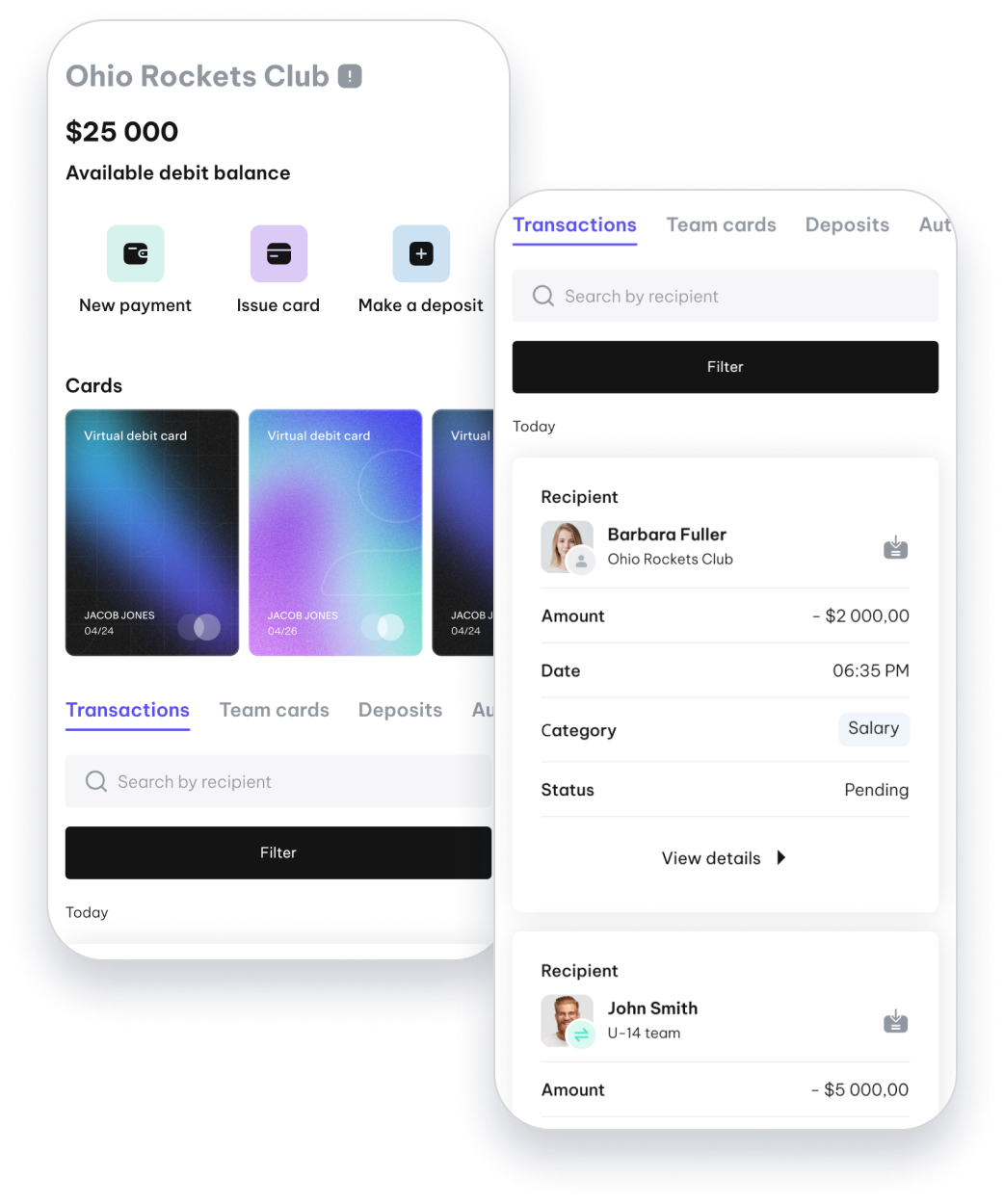

Mobile banking and debit cards

To easily issue virtual and physical cards to teams and coaches.

Accounting, tax reporting, and compliance

To compare accountants and find the best fit for reporting needs.

Complete financial oversight and governance

To guide the organization in financial opportunities

Store deposits securely from anywhere

To easily issue virtual and physical cards to teams and coaches.

Distribute funds across sub-accounts

To easily issue virtual and physical cards to teams and coaches.

Governance and oversight for reporting and compliance

Provide the board of directors with the proper governance and oversight for reporting and compliance

Transaction notifications

Stay up-to-date with the org’s cash flow with transaction notifications

A partner from end to end

Technical Design Workshops

Existing MVP prototype architecture, non-functional goals, and potential architecture patterns.

Vendor Selection + Technical Design

Key technology selections and cloud deployment approach.

UX Design

User flow diagrams and wireframes representing a landing page concept and design review for the PH 3.0 platform.

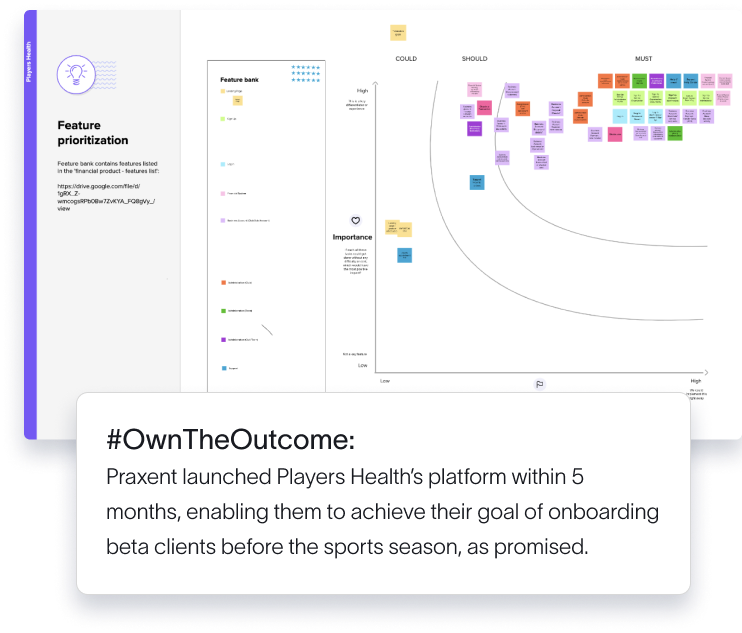

V1 Feature Prioritization and MVP Agile Dev

Comprehensive feature list for first product release.

Launch

In less than 6 months, enabling the onboarding of 50 SMBs at launch.

Strategic Value Engineering:

To meet our client’s goal of launching before the upcoming sports season, we faced a tight 5-month deadline.

We used lean methodology to focus on essential early-stage features, achieving an MVP within the timeline. The product is designed for iterative evolution, based on real user feedback.

14+ years of experience in financial services.

Payments specialist.

Strategic and large-scale finance initiatives lead at PayFlex

Strategic Value Engineering:

When we kicked off our engagement, Players Health had a handful of designs from an agency that they’d worked with previously.

Unfortunately, these designs didn’t fully match the vision that the client had, so we focused on prioritizing specific features and re-designed the product to align with their goal.

9+ years of experience in human-centered UX / UI design.

BNPL specialist.

CitiBank’s BNPL experience Home Depot’s commercial credit card application

<6

Month launch

$30M

Series B funding

50+

SMBs onboarded in beta

5

Fintech provider integrations

Compliance-approved accounts ledger on Thread Bank’s core

What Players Health had to say

Tyrre Burks

CEO Players Health