A case study by Praxent⌘

Neobank for CannaBusinesses launched within

7 months

A simple, bespoke, and compliant commercial banking and payments platform for cannabis merchants.

The growing cannabis industry faces financial and regulatory challenges as businesses navigate compliance with federal and state regulations, hindering their access to traditional banking services and payment rails.

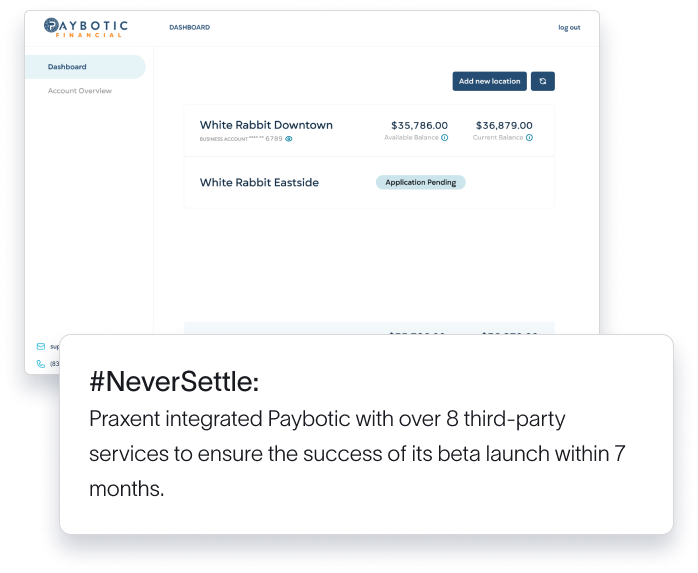

Paybotic partnered with Praxent to design and develop a commercial banking portal so operators and consumers across the U.S. can access digital banking, payments and cash management solutions.

- KYC/KYB Account Opening

- CRB Monitor Integration

- Commercial Digital Banking

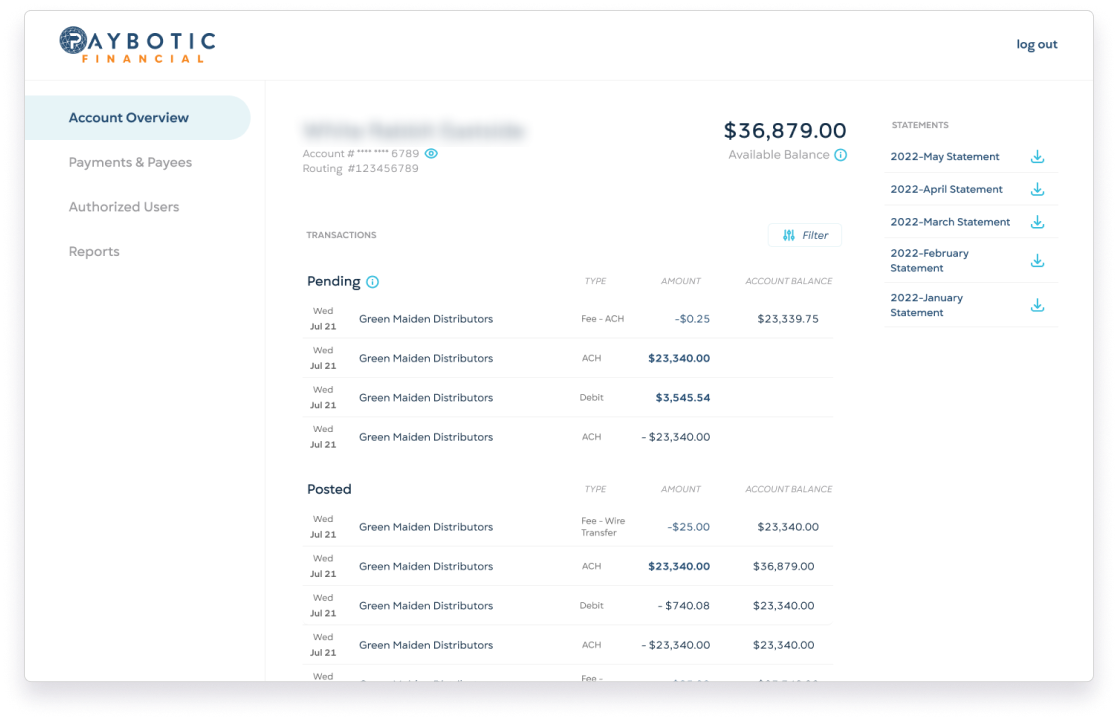

- Payments (ACH, Wire, Closed Loop)

- Debit Cards

- Account Management

- BaaS, card issuing + data provider integrations

- Launched within 7 months

- Regulatory-compliant bank account opening

- 8+ fintech integrations

- ACH, wire, and closed-loop payments

- Corporate credit cards

The challenges

Highly regulated

Cannabis dispensaries and cannabis-related businesses are highly regulated and stigmatized from a banking perspective. Meeting the bank’s compliance requirements can be a challenge.

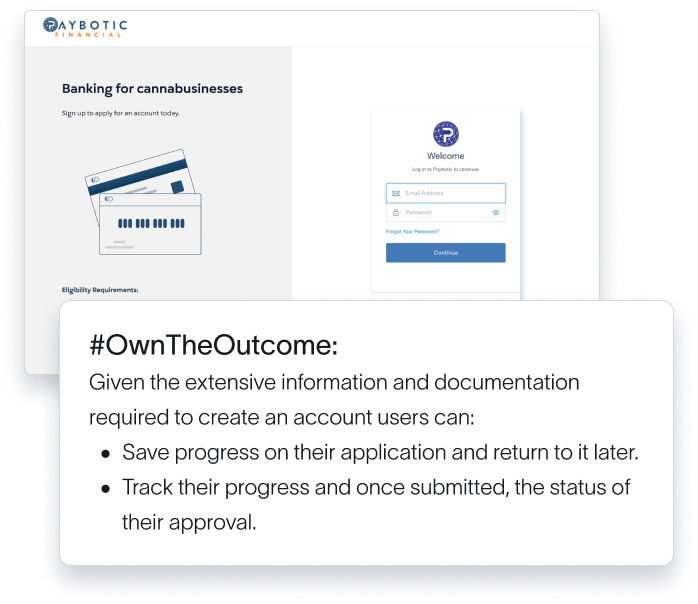

Complex, length onboarding

Given the risk to the bank for custodying cannabis-related business accounts, onboarding requires extensive documentation to prove the legitimacy and legality of the businesses.

Merchant services

Since cannabis is not federally legal, most banks avoid the complexity of offering merchant services to cannabis businesses, leaving many unable to receive or send payments.

Limited in-house capacity

Paybotic had strong capabilities in payment processing but needed custom frontend development and integration support to bring their vision to market.

The vision for Paybotic Financial

Paybotic offers commercial bank accounts and merchant services for cannabusinesses. Quick setup process with fast approvals, often within 48 hours of application submission, while also prioritizing reliability and security, safeguarding company data, and maintaining a dedicated team of experts experienced in working with high-risk businesses.

Streamlined, compliant account opening

Data-integrated onboarding

ACH, wire, and closed-loop payments

24/7 mobile banking

Corporate cards and expense management

What Paybotic had to say

Eveline Dang

Co-Founder Paybotic Financial