A case study by Praxent⌘

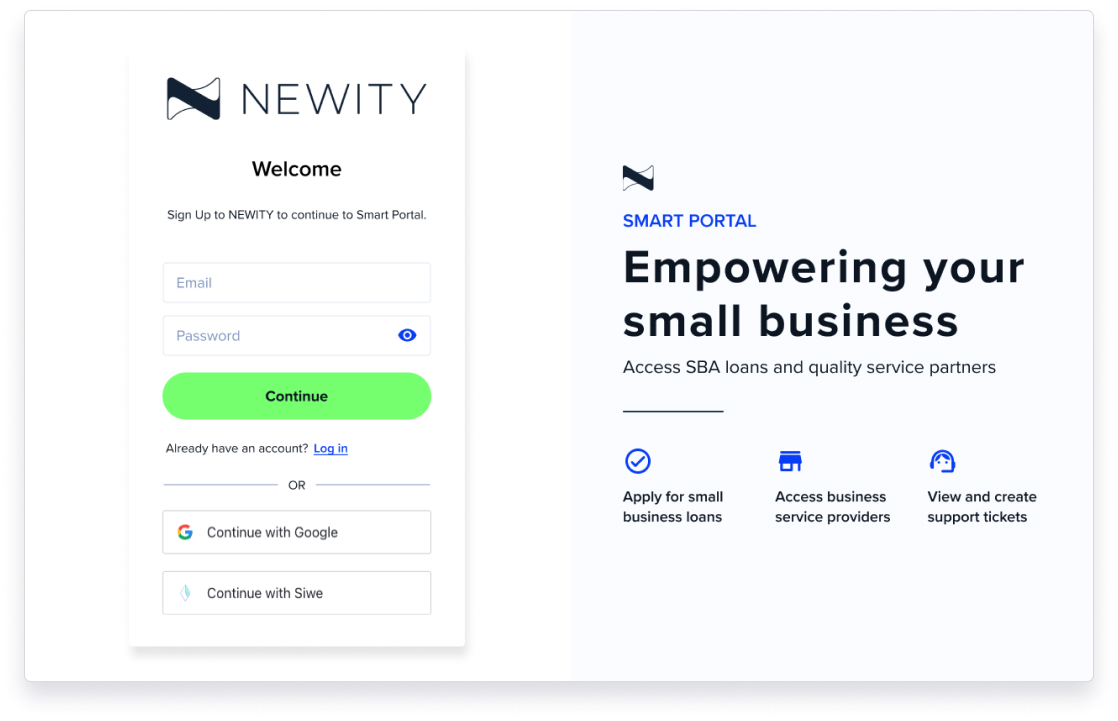

An agile, tech-forward small business capital access platform

An $11.4B PPP loan servicing firm had a vision for an integrated, data-driven SMB lending platform

NEWITY initially partnered with Praxent to redevelop its borrower portal and streamline loan servicing. As the partnership progressed, soon NEWITY was launching products every 12 weeks. Now, they’re the #1 SBA Loan Facilitator and a one-stop system helping 120,000+ small businesses access billions in capital.

Borrower Portal

Loan Origination

Pre-Qualification

ERC Application

16 Fintech Integrations

- 32% reduction in customer support tickets

- 85% loan origination conversion rate

- 67% reduction in underwriting (27 hours per week)

The vision for NEWITY

Expand client LTV

NEWITY needed to go beyond PPP loans and expand into additional capital programs.

– PPP loans

– 7 (a) loans

– Employee Retention Credit (ERC)

Scalable underwriting

With such growth, maximizing efficiency was key. Enabling underwriters to only spend time on qualified applications with a Pre-Qualification flow allowed for scale.

Fast-paced technology partner

An agile technology foundation would allow NEWITY to stay one step ahead of customer expectations. To deliver this, they needed a fintech-specialized strategic technology partner.

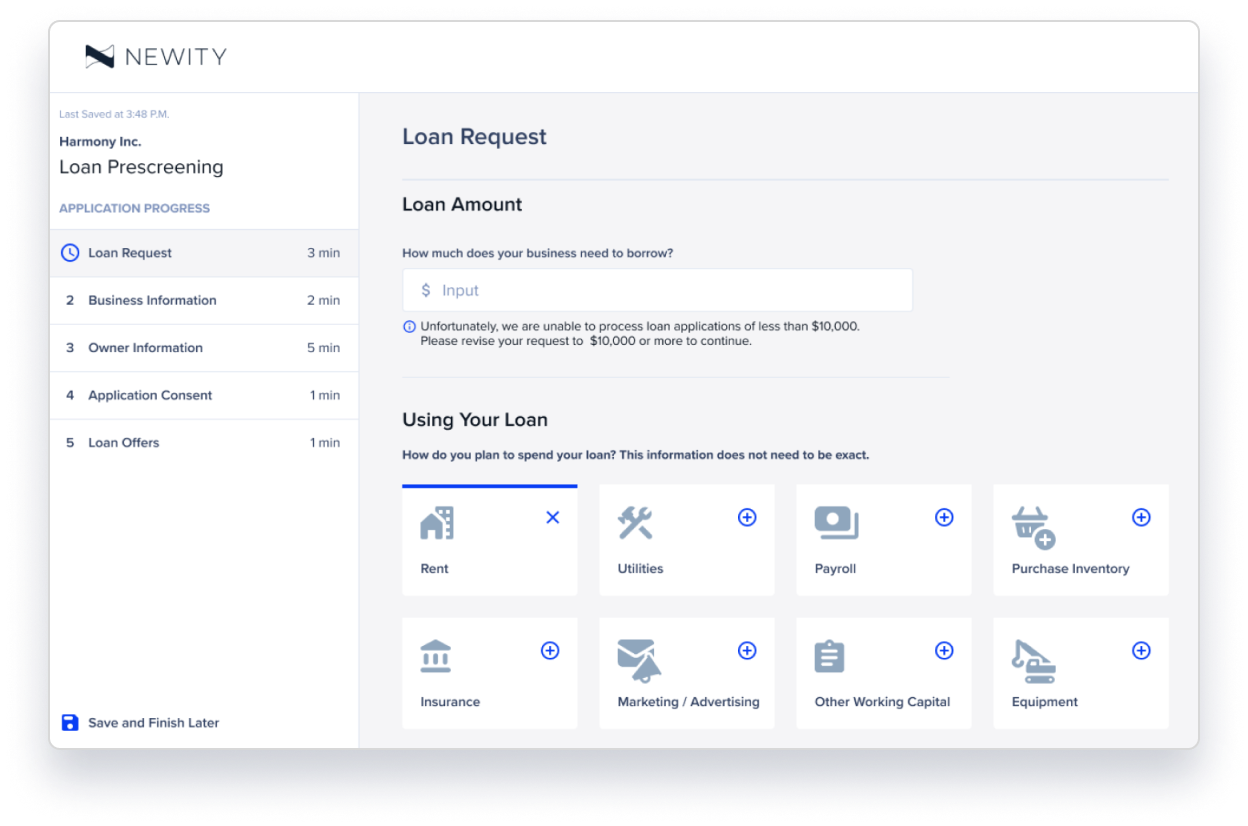

Effortless applications

To differentiate from legacy SMB lenders, the application processes needed to be frictionless and fast.

Agile platform

The lending market can be fast-paced and it takes agility to succeed and capture opportunities quickly.

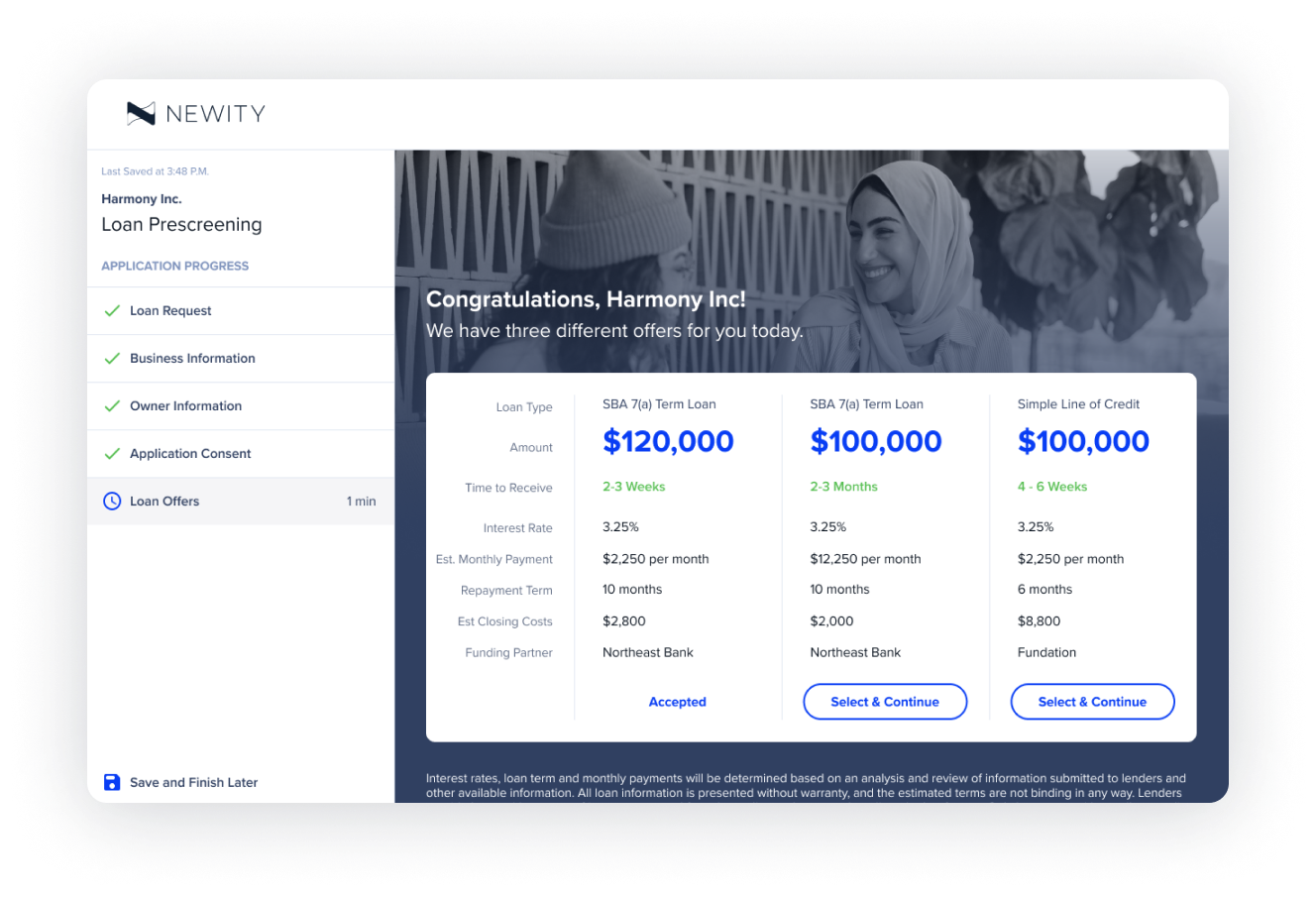

Pre-Qualification and Loan Origination

47%

UNQUALIFIED APPLICATIONS AUTO-REJECTED UPFRONT

85%

conversion rate OF QUALIFIED APPLICANTS

27

UNDERWRITING HOURS SAVED PER WEEK (67% OF A FTE)

13

weeks to launch

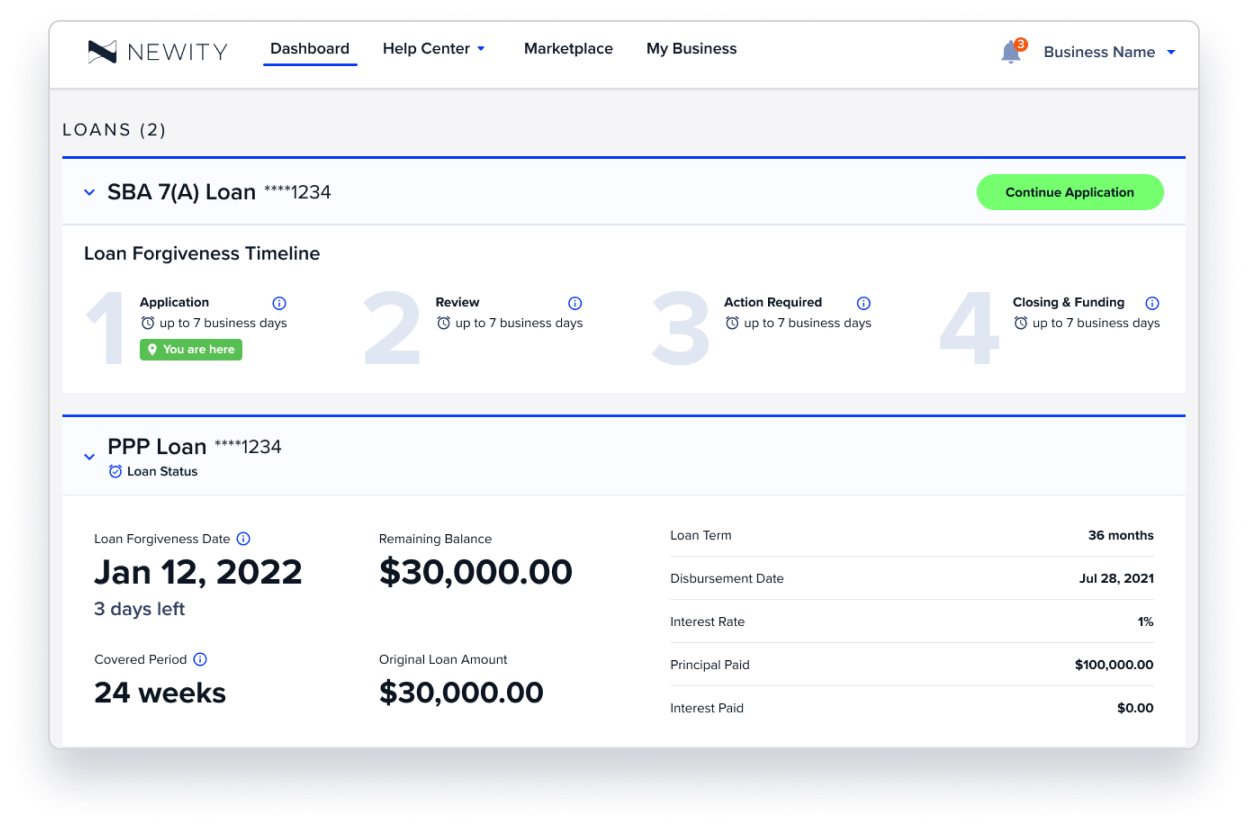

Borrower Portal

42%

decrease in borrower emails

32%

Decrease in overall customer support tickets

VOTED BEST BUSINESS SERVICES MARKETPLACE (LENDVER)

13

weeks to launch

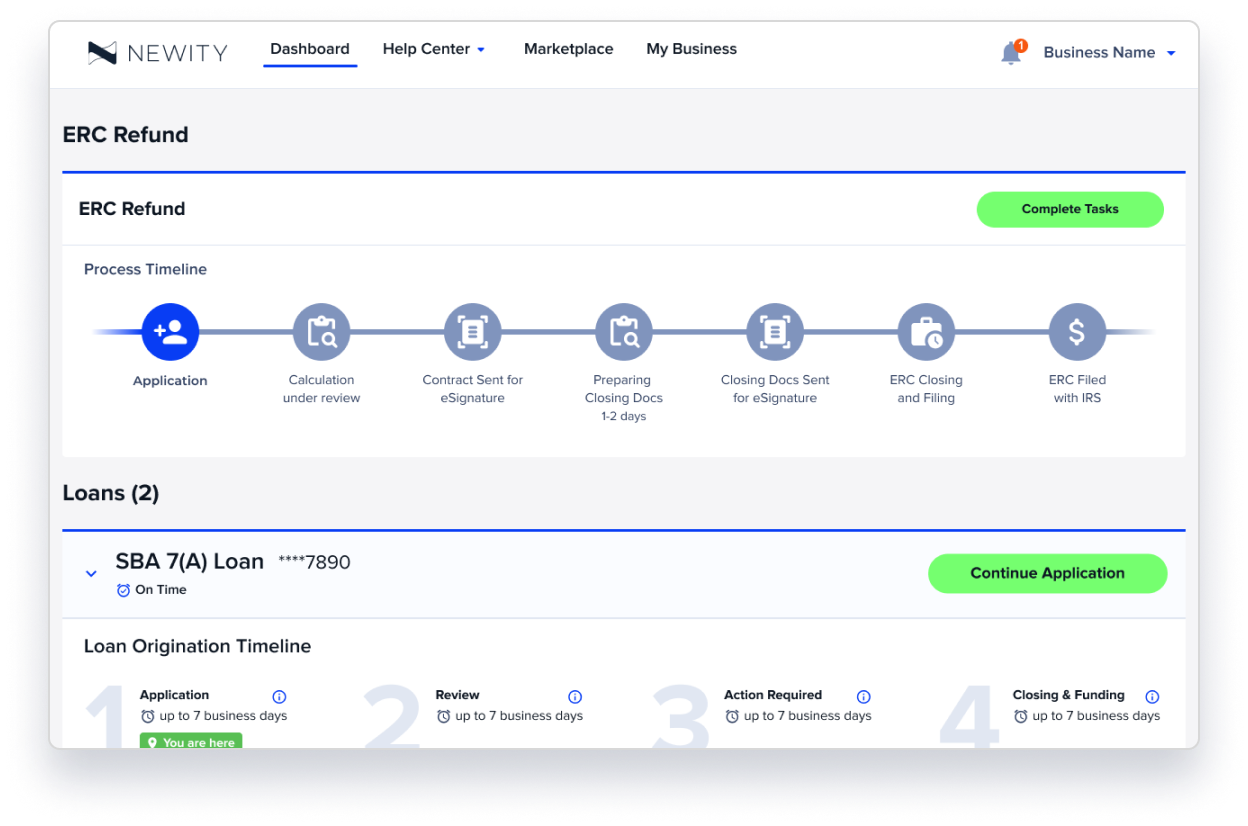

ERC Products

+950

applications processed

$130K

average ERC refund

VOTED BEST BUSINESS SERVICES MARKETPLACE (LENDVER)

14

weeks to launch

What NEWITY had to say

Bryan Hallene

COO, NEWITY

A partner from end to end

UX Strategy and Design

Full-Stack Development

Systems Integration

DevOps Implementation

Quality Assurance

CRM Data Orchestration

See the platform in action

Stitching together services has given NEWITY the power to serve their customers uniquely. They can show customers their data in accessible, informative, and actionable ways. They can understand their customers and offer them helpful services that help their businesses grow.

15+ years of experience in digital products, fintech integrations, personalizations, and value engineering