CUSTOM REPORT

Digital Banking Maturity Model

The digital maturity gap is widening with leading institutions offering superior customer experiences that drive increased customer adoption, engagement, and stickiness.

Where does your institution stand?

Request a custom report for your institution, created by our digital banking specialists.

Product Features

- Break down the 5 levels of maturity

- Determine where your institutions falls

- See real-life examples of institutions at each level

- Concrete steps to level up

The 5 levels of digital banking maturity

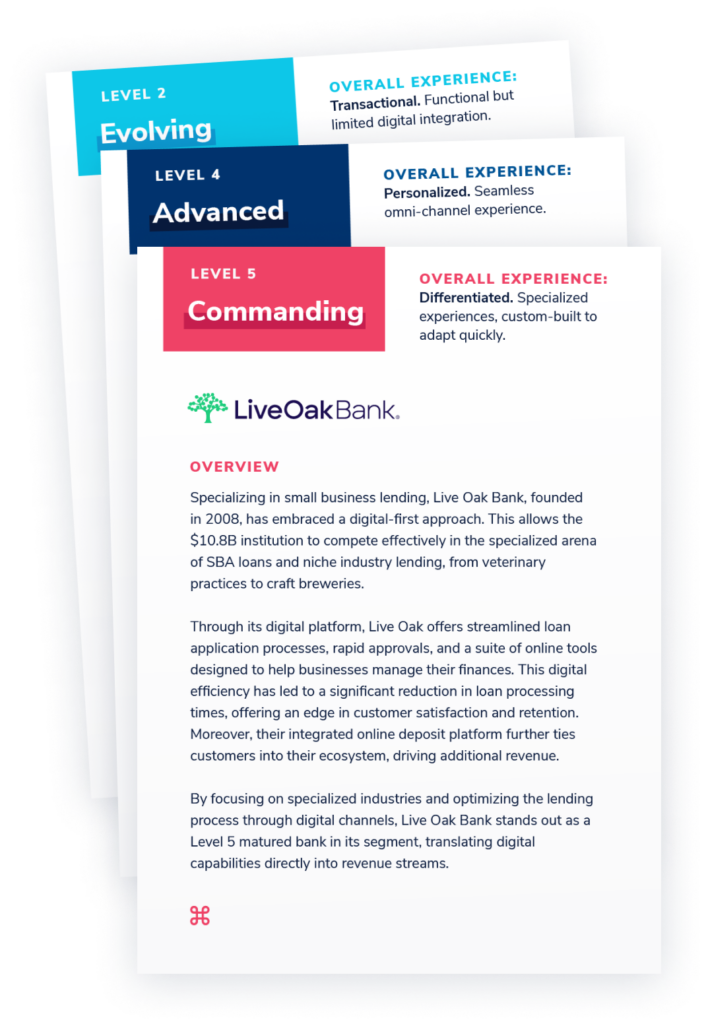

Embarking

Informational.

Primarily content-focused web presence.

Evolving

Transactional.

Functional but limited digital integration.

Robust

Optimized.

Robust digital offerings, enhanced for usability.

Advanced

Personalized.

Seamless omni-channel experience.

Commanding

Differentiated.

Specialized experiences, custom-built to adapt quickly.

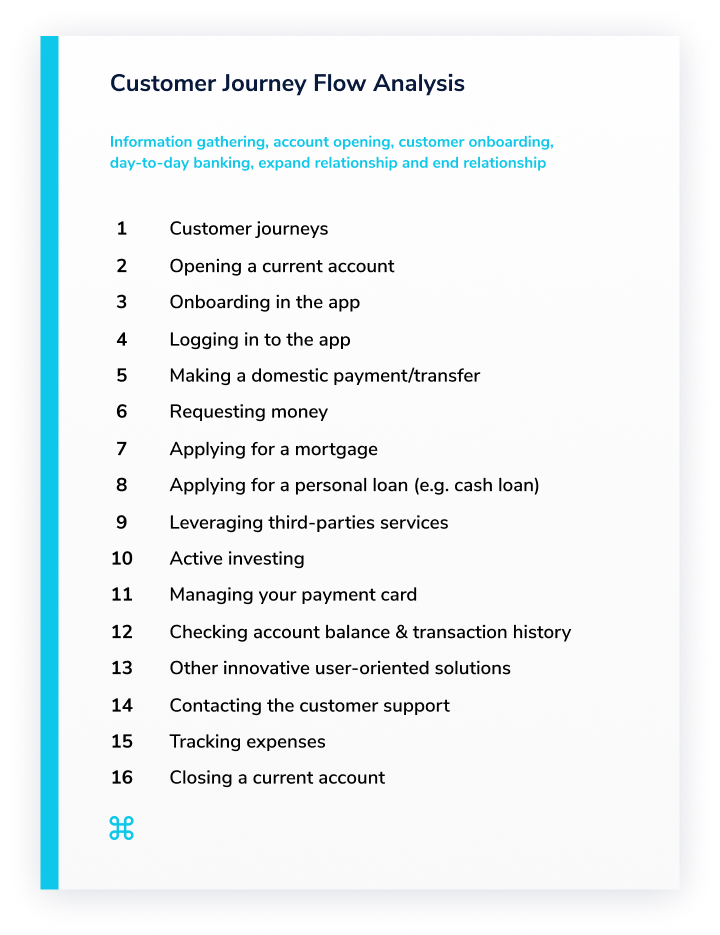

From gathering information from your marketing site to closing the account.

We’ll analyze over

15 customer journey flows

We’ll give you a competitor baseline

See real-life examples of financial institutions at each stage of digital maturity.

and concrete steps to move forward.

We’ll share the signs it might be time to level up and specific, actionable insights on where to prioritize your investments for maximum return on your digital roadmap.

Praxent accelerates the development of differentiated fintech products and

experiences that produce measurable results.

We help fintechs and financial services firms

acquire and enrich their customer relationships through the latest in human-centered design, software engineering, and fintech product integrations.

Over

projects delivered

in business

120+ designers & developers