A case study by Praxent⌘

Retirement savings without the guesswork

Over 75,000 participants served with MyPlanConnection, a mobile app built to simplify 401k investing.

BlueStar—now an Ameritas company—partnered with Praxent to disrupt the market with a 401k robo-advisor mobile app focused on retirement-readiness. The consultative guided experience educates, handles transactions, and caters to diverse investment needs.

APEX-powered investing

Robo-advisor portfolios

GuideMe enrollment wizard

Retirement income projections

Manage contributions

Face ID and fingerprint login

- BlueStar was acquired by Ameritas shortly after launch

- 4 months to V1 launch

- 4.5 app store rating

- APEX integration

The challenges

Losing Customers

Existing customers were moving to competitors and prospective customers dismissed BlueStar due to the lack of a mobile app offering to serve plan employees.

Competitive Landscape

Struggled to keep up with competitors using advanced technologies, especially native mobile apps, impacting their value proposition and market competitiveness.

Fraud Protection

Retirement funds experience the highest percentage of fraud in the financial industry. A new mobile app created a potential breach risk.

Adapting to User Diversity

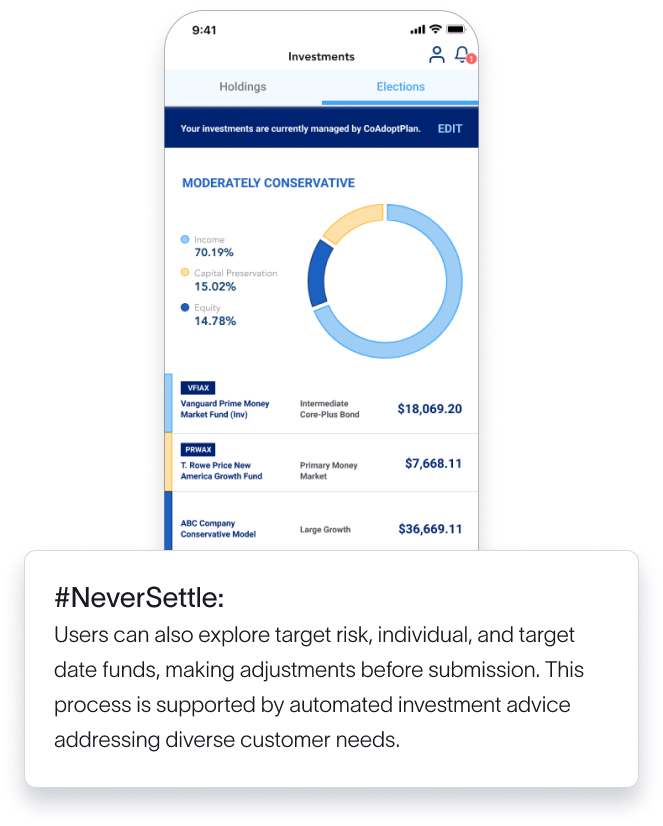

Catering to participants’ diverse investment needs, considering factors like age and risk tolerance, was challenging, demanding a personalized, guided user experience.

High-Complexity

Investing and employee benefits are complex topics that often confuse employees. Given the impact on users lives, creating a simplified, educational experience was key.

The vision for Ameritas

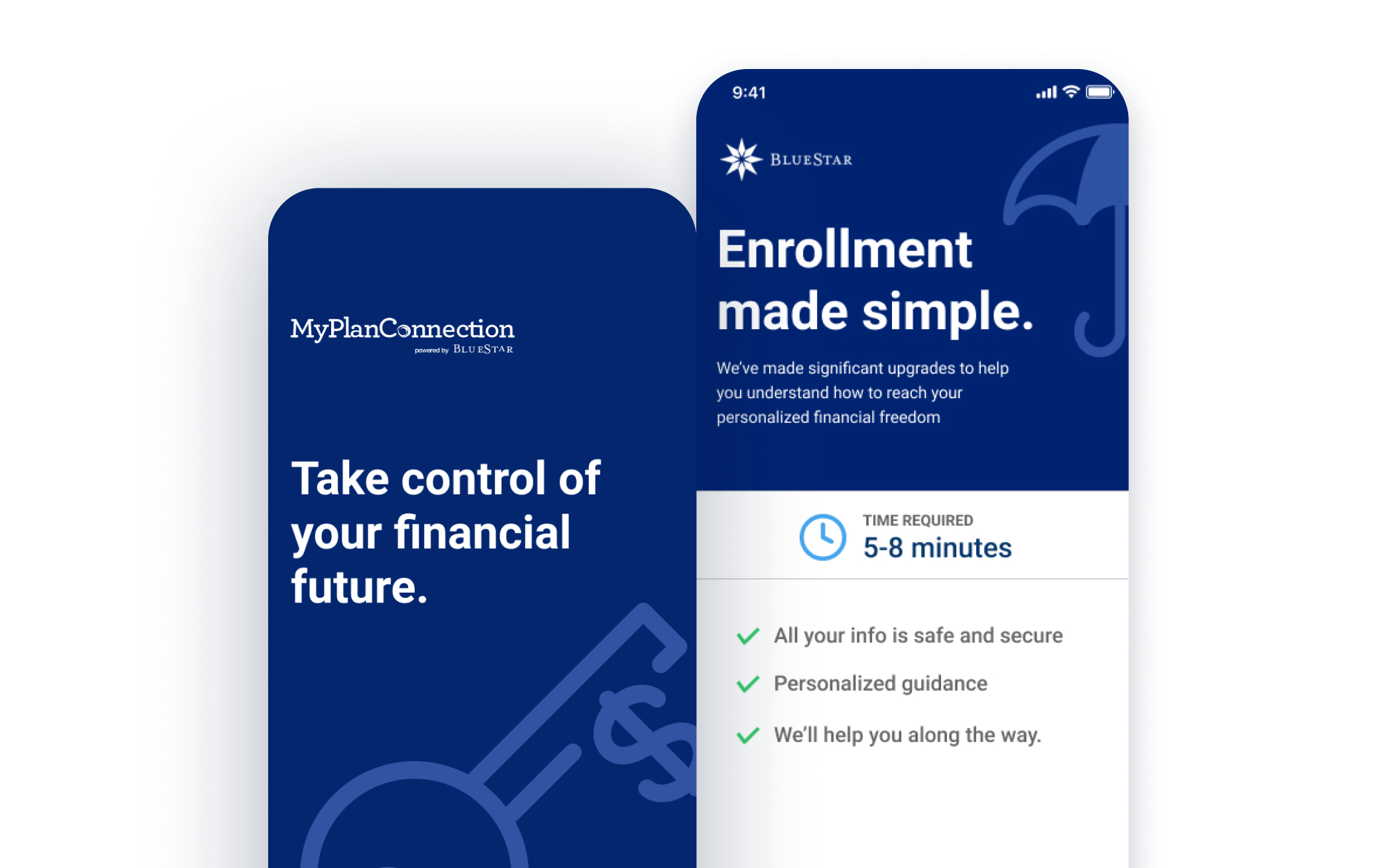

GuideMe Enrollment

Transaction-capable guided enrollment flow that helps participants select their contributions, investments, and manage their beneficiaries.

Robo-Advisor Investing

Powered by an APEX integration, participants receive automated and personalized investment portfolio recommendations.

Retirement Snapshot

Users can set goals for their retirement and show progress towards those goals in a simple, easy-to-understand format.

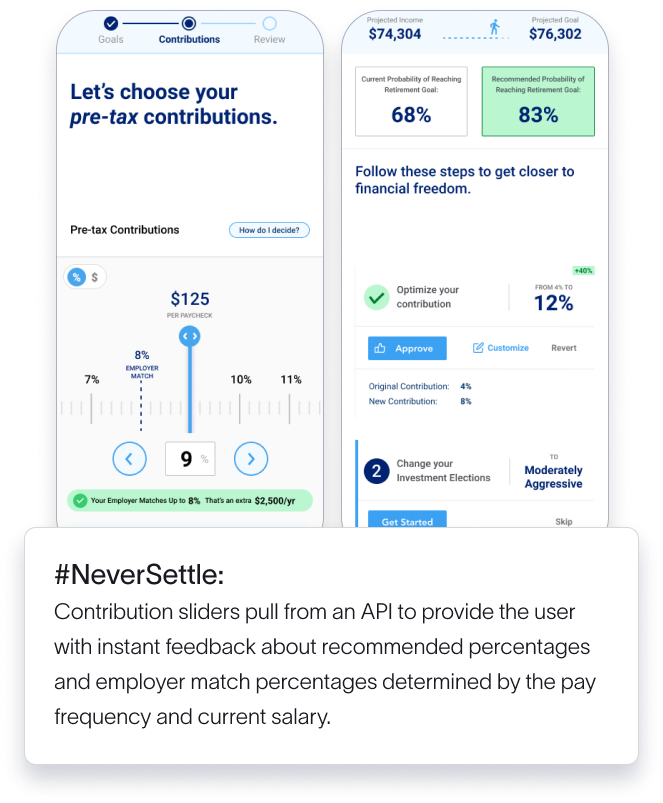

Retirement Income Projections

Employees can review their projected retirement income and quickly make changes to their retirement roadmap. The app offers suggestions to improve the projected retirement numbers.

Maximizing Contribution Match

Employees can easily update the contribution amount with guidance on how to maximize the employer’s contribution matching plan and take advantage of the plan’s tax benefits.

Mobile App Features

Verifies user’s identity based on their device with face ID on iPhone and fingerprint login on android. Push notifications encourage users to engage with the application, new features, marketing messaging and updates.

A partner from end to end

User Research

UX Design

ClickModel® Prototype

Design System

iOS and Android native mobile apps

Systems Integration

QA and Deployment Strategy

Must-have features faster.

6 months faster.

The technical strategy we proposed accelerated BlueStar’s launch by 6-8 months without compromising on go-live functionality.

15+ years of experience in digital products, fintech integrations, personalizations, and value engineering

Securing business against future challenges

4

months to launch version 1.0

4.5

rating in app store with its first mobile app version

APEX

DIGITAL CUSTODIAN INTEGRATION

What Ameritas had to say

Suzanne Werner

Executive VP, BlueStar/Ameritas